This week's biggest funding round

Figure Technologies raised $60M in a Series A funding round from Jump Crypto*, Pantera Capital*, Lightspeed Faction*, Distributed Global, Ribbit Capital, CMT Digital.

Figure Technologies is a financial technology company pioneering decentralized solutions such as Figure Markets, an exchange built on the Provenance blockchain for trading a variety of securities and crypto assets. Utilizing multi-party computation (MPC) wallets, Figure Markets mitigates single-point-of-failure risks inherent in centralized exchanges, promoting efficiency and security in digital asset markets. Additionally, Figure is innovating in the realm of stablecoins, aiming to offer a registered security alternative with yield-generating capabilities.

Figure Technologies is a financial technology company pioneering decentralized solutions such as Figure Markets, an exchange built on the Provenance blockchain for trading a variety of securities and crypto assets. Utilizing multi-party computation (MPC) wallets, Figure Markets mitigates single-point-of-failure risks inherent in centralized exchanges, promoting efficiency and security in digital asset markets. Additionally, Figure is innovating in the realm of stablecoins, aiming to offer a registered security alternative with yield-generating capabilities.

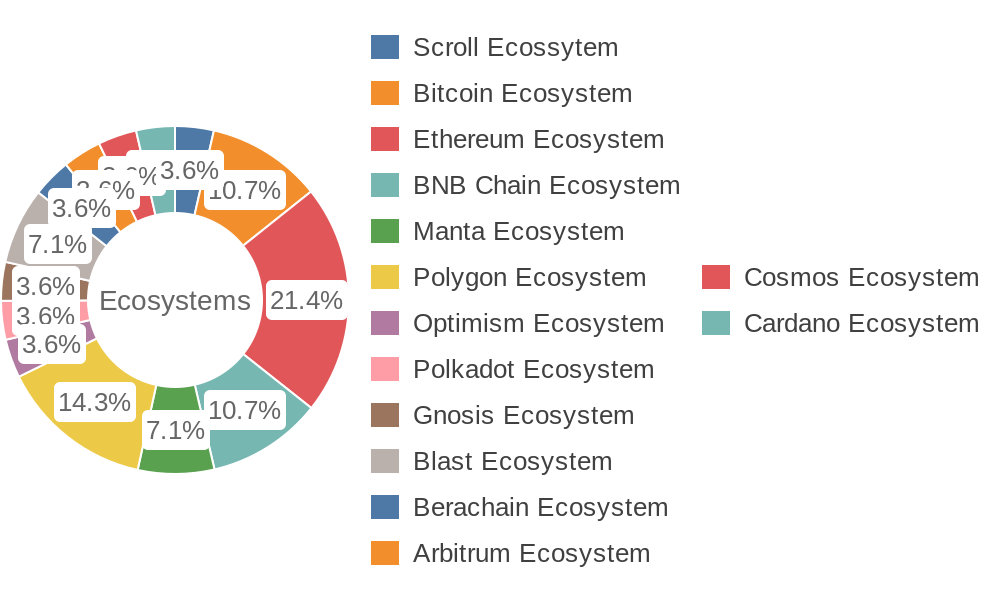

Pre-seed and Seed investment rounds

Rollie Finance raised undisclosed amount in a Seed funding round from Animoca Ventures, M77 Ventures, Sandy Peng, Alex Lee, Kate Wong.

Rollie Finance is the native perpetual decentralized exchange (perp dex) on the Scroll Mainnet, offering unmatched speed, low gas fees, and high capital efficiency. With a user-centric interface and innovative features like social trading and prediction markets, Rollie Finance provides a transparent and secure trading environment powered by the $RF token.

Rollie Finance is the native perpetual decentralized exchange (perp dex) on the Scroll Mainnet, offering unmatched speed, low gas fees, and high capital efficiency. With a user-centric interface and innovative features like social trading and prediction markets, Rollie Finance provides a transparent and secure trading environment powered by the $RF token.

Sablier raised $4.5M in a Seed funding round from A Capital, Fenbushi Capital, WAGMI Ventures, FounderHeads VC, DCV Capital, Ben Middleton, Kartik Talwar, Igor Barinov, David Truong, Auryn Macmillan, Kerman Kohli, Lito Coen.

Sablier is a free-to-use protocol offering on-chain token distribution and money streaming services. It's designed for DAOs, businesses, and individuals, supporting various use cases like payroll, vesting, airdrops, and grants. Recipients can access funds in real-time, promoting flexibility and efficiency. Sablier stands out for its customizable distribution models, bulk stream creation, and unique NFT Hourglass feature, enhancing DeFi composability.

Sablier is a free-to-use protocol offering on-chain token distribution and money streaming services. It's designed for DAOs, businesses, and individuals, supporting various use cases like payroll, vesting, airdrops, and grants. Recipients can access funds in real-time, promoting flexibility and efficiency. Sablier stands out for its customizable distribution models, bulk stream creation, and unique NFT Hourglass feature, enhancing DeFi composability.

OpenStamp raised undisclosed amount in a Seed funding round from Animoca Ventures*, KuCoin Ventures, MH Ventures, Lotus Capital, Brotherhood, Bluenode Capital, D64 Ventures, Luminescence Capital, Spicy Capital, Halvings Capital, SPEC Capital, YM Capital.

OpenStamp is a one-stop service platform developed on the STAMP Protocol, known for its robust security within the Bitcoin ecosystem, offering various products such as its Mint/Deploy service, SRC-20/SRC-721 Marketplace, Indexer, Explorer, and Launchpad. It serves as a pioneering force in propelling the SRC ecosystem forward, aiming to expand and refine its platform to contribute to the growth of the SRC ecosystem while continuing to serve its users effectively.

OpenStamp is a one-stop service platform developed on the STAMP Protocol, known for its robust security within the Bitcoin ecosystem, offering various products such as its Mint/Deploy service, SRC-20/SRC-721 Marketplace, Indexer, Explorer, and Launchpad. It serves as a pioneering force in propelling the SRC ecosystem forward, aiming to expand and refine its platform to contribute to the growth of the SRC ecosystem while continuing to serve its users effectively.

Tensorplex Labs raised $3M in a Seed funding round from Canonical Crypto*, Collab+Currency*, Digital Currency Group (DCG), Quantstamp, Amber Group.

Tensorplex Labs is a Web3 and artificial intelligence (AI) startup, focused on constructing capital and intelligence infrastructure for decentralized AI networks. Their mission is to foster the growth of decentralized AI, integrating it with blockchain technology to create a versatile and interoperable digital infrastructure that amplifies the potential of AI while enabling seamless integration with decentralized finance (DeFi) applications.

Tensorplex Labs is a Web3 and artificial intelligence (AI) startup, focused on constructing capital and intelligence infrastructure for decentralized AI networks. Their mission is to foster the growth of decentralized AI, integrating it with blockchain technology to create a versatile and interoperable digital infrastructure that amplifies the potential of AI while enabling seamless integration with decentralized finance (DeFi) applications.

SAVAGE raised undisclosed amount in a Seed funding round from Faculty Group*, P2 Ventures (Polygon Ventures), Morningstar Ventures, Moonboots Capital, Firm9Zero, VBC Ventures, Fantomstarter, Vendetta Capital, Ash Crypto.

Savage is the carbon-neutral NFT platform tailored for filmmakers and photographers, leveraging Polygon's proof of stake protocol to set a new standard for NFT marketplaces. With features like "Team NFTs" and Rights Managed Contracts integrated into metadata, along with support for various file formats and sizes, Savage offers creators affordable minting, generous payouts, and environmental initiatives, ensuring peace of mind when uploading content.

Savage is the carbon-neutral NFT platform tailored for filmmakers and photographers, leveraging Polygon's proof of stake protocol to set a new standard for NFT marketplaces. With features like "Team NFTs" and Rights Managed Contracts integrated into metadata, along with support for various file formats and sizes, Savage offers creators affordable minting, generous payouts, and environmental initiatives, ensuring peace of mind when uploading content.

Rails raised $6.2M in a Seed funding round from Slow Ventures*, CMCC Global, Round13 Capital, Quantstamp.

Rails is a self-custodial crypto exchange that optimizes trade execution with a centralized order book, while ensuring transparent custody of funds through a decentralized solution on the blockchain. This unique approach enhances security and trust by offering users full visibility into fund custody operations.

Rails is a self-custodial crypto exchange that optimizes trade execution with a centralized order book, while ensuring transparent custody of funds through a decentralized solution on the blockchain. This unique approach enhances security and trust by offering users full visibility into fund custody operations.

Morph raised $20M in a Seed funding round from Dragonfly Capital*, Pantera Capital, Foresight Ventures, The Spartan Group, MEXC, Symbolic Capital (ex Hyperedge Capital), Public Works, MH Ventures, Everyrealm, Sandeep Nailwal, Alex Svanevik, NaniXBT, dingaling, Anthony Beaumont, icebergy, Cristian Manea.

Morph is a Layer 2 consumer blockchain that combines Optimistic and ZK roll-up technologies, providing efficient scaling and security for value-driven decentralized applications (dApps). Its features, including a Decentralized Sequencer Network and Responsive Validity Proof system, aim to ensure scalable, secure, and cost-effective Layer 2 transactions while countering issues like MEV dominance.

Morph is a Layer 2 consumer blockchain that combines Optimistic and ZK roll-up technologies, providing efficient scaling and security for value-driven decentralized applications (dApps). Its features, including a Decentralized Sequencer Network and Responsive Validity Proof system, aim to ensure scalable, secure, and cost-effective Layer 2 transactions while countering issues like MEV dominance.

EarlyFans (Atticc Labs) raised $1.5M in a Seed funding round from Alliance DAO (ex DeFi Alliance), SNZ Holding, GSR Markets LTD, Zee Prime Capital, Genesis Block Ventures Capital (GBV), ProDigital Future Fund, Alchemy Ventures, CyberConnect, NaniXBT, Zeneca, Suji Yan, Ryan Li, icebergy.

EarlyFans is a SocialFi application built on the Blast ecosystem, aimed at enabling creators to monetize their content directly without relying on advertisements or merchandise sales. It rewards fans who support creators. Additionally, EarlyFans introduces $EARLY as a utility, governance token within Atticc Labs' ecosystem of SocialFi protocols and applications, marking a significant step towards decentralization and community participation in shaping its future.

EarlyFans is a SocialFi application built on the Blast ecosystem, aimed at enabling creators to monetize their content directly without relying on advertisements or merchandise sales. It rewards fans who support creators. Additionally, EarlyFans introduces $EARLY as a utility, governance token within Atticc Labs' ecosystem of SocialFi protocols and applications, marking a significant step towards decentralization and community participation in shaping its future.

Ooga Booga raised $1M in a Seed funding round from Kenetic*, Cypher Capital, Rubik Ventures, Rana Capital, Baboon VC, CitizenX Crypto Ventures, Nural Capital, Wizards Capital, Kestrel 0x1, BlockBuilders, Panony, Sneaky Ventures, BeraLand, Sandeep Nailwal, DCF God, NaniXBT, 0xSisyphus, Janitooor, Kirby Ong, John Fiorelli.

Ooga Booga is a decentralized exchange aggregator built on Berachain, designed to help traders find the most cost-effective crypto swaps across various exchanges. It serves as Berachain's native liquidity aggregator, enhancing the efficiency and accessibility of decentralized trading on the platform.

Ooga Booga is a decentralized exchange aggregator built on Berachain, designed to help traders find the most cost-effective crypto swaps across various exchanges. It serves as Berachain's native liquidity aggregator, enhancing the efficiency and accessibility of decentralized trading on the platform.

Mystiko Network raised $18M in a Seed funding round from Peak XV Partners (ex as Sequoia India & South East Asia)*, Samsung Next, Hashkey Capital, Mirana Ventures, Signum Capital, CoinList, Tribe Capital, Morningstar Ventures, Naval Ravikant, Sandeep Nailwal, Gokul Rajaram.

Mystiko Network is the foundational zero-knowledge technology layer of Web3, offering a universal ZK protocol and development kit for scalability, interoperability, and privacy. Serving as the privacy infrastructure for blockchain data and applications, Mystiko enables confidential transactions, private asset management, and shielded business decisions across Layer 1, Layer 2, wallets, bridges, and decentralized exchanges. With Mystiko, individuals can safeguard their financial privacy, while developers can easily integrate privacy features into their decentralized applications.

Mystiko Network is the foundational zero-knowledge technology layer of Web3, offering a universal ZK protocol and development kit for scalability, interoperability, and privacy. Serving as the privacy infrastructure for blockchain data and applications, Mystiko enables confidential transactions, private asset management, and shielded business decisions across Layer 1, Layer 2, wallets, bridges, and decentralized exchanges. With Mystiko, individuals can safeguard their financial privacy, while developers can easily integrate privacy features into their decentralized applications.

Keyring Network raised $6M in a Seed funding round from gumi Cryptos Capital (gCC)*, Greenfield Capital*, Motier Ventures, Kima Ventures, UDHC, Eberg Capital.

Keyring provides financial service providers with permissioning tools for compliant transactions on-chain, utilizing zero-knowledge privacy. It enables clients to meet regulatory requirements while unlocking secondary market liquidity with reusable compliance measures. This solution addresses challenges such as centralization and data siloes by fostering programmable rule-based permissioning across platforms, ultimately enhancing connectivity and facilitating seamless interactions between different financial entities.

Keyring provides financial service providers with permissioning tools for compliant transactions on-chain, utilizing zero-knowledge privacy. It enables clients to meet regulatory requirements while unlocking secondary market liquidity with reusable compliance measures. This solution addresses challenges such as centralization and data siloes by fostering programmable rule-based permissioning across platforms, ultimately enhancing connectivity and facilitating seamless interactions between different financial entities.

Umoja Labs raised $2M in a Seed funding round from Coinbase Ventures, 500 Startups (500 Global), Quantstamp, Blockchain Founders Fund, Orange DAO, Hyperithm, Psalion VC, Blizzard.

Umoja is a cutting-edge financial platform offering market loss protection for digital asset investments. It enables users to hedge against the exposure risk of fiat, crypto, and real-world assets in a cost-effective manner. The platform stands out by allowing anyone to participate in or create a risk hedging strategy with features like high liquidity, low counterparty risk, and minimal upfront costs. Umoja operates by trading perpetual futures, options, and bonds on-chain, replicating traditional hedging instruments, thereby democratizing the process of market risk minimization.

Umoja is a cutting-edge financial platform offering market loss protection for digital asset investments. It enables users to hedge against the exposure risk of fiat, crypto, and real-world assets in a cost-effective manner. The platform stands out by allowing anyone to participate in or create a risk hedging strategy with features like high liquidity, low counterparty risk, and minimal upfront costs. Umoja operates by trading perpetual futures, options, and bonds on-chain, replicating traditional hedging instruments, thereby democratizing the process of market risk minimization.

Zone (ex Appzone) raised $8.5M in a Seed funding round from Flourish Ventures*, TLcom Capital*, Digital Currency Group (DCG), VKAV (Verod-Kepple Africa Ventures), Alter Global.

Zone is a regulated blockchain network designed to facilitate payments and digital currency transactions, connecting institutions directly and automating settlement processes. With a focus on bridging traditional fiat currencies with digital currencies, Zone prioritizes financial inclusion and aims to enable efficient cross-border payments. Additionally, Zone offers developer support and tools to build innovative payment and decentralized finance solutions on its network, fostering a community of world-class developers driving the adoption of digital payments.

Zone is a regulated blockchain network designed to facilitate payments and digital currency transactions, connecting institutions directly and automating settlement processes. With a focus on bridging traditional fiat currencies with digital currencies, Zone prioritizes financial inclusion and aims to enable efficient cross-border payments. Additionally, Zone offers developer support and tools to build innovative payment and decentralized finance solutions on its network, fostering a community of world-class developers driving the adoption of digital payments.

Crypto Rogue Games (Crystals of Naramunz) raised $1.5M in a Seed funding round from Merit Circle, Avalanche, CoinFund, SNZ Holding, Lyrik Ventures, Devmons, Bryan Pellegrino.

Crypto Rogue Games is a Swedish game studio dedicated to revolutionizing gaming by integrating blockchain technology. Their flagship project, Crystals of Naramunz, is an action RPG set in a post-apocalyptic steampunk world, drawing inspiration from titles like Diablo and Path of Exile. With a focus on talent, creativity, and community, Crypto Rogue Games aims to create immersive gaming experiences that captivate players and push the boundaries of the industry.

Crypto Rogue Games is a Swedish game studio dedicated to revolutionizing gaming by integrating blockchain technology. Their flagship project, Crystals of Naramunz, is an action RPG set in a post-apocalyptic steampunk world, drawing inspiration from titles like Diablo and Path of Exile. With a focus on talent, creativity, and community, Crypto Rogue Games aims to create immersive gaming experiences that captivate players and push the boundaries of the industry.

Other investment rounds

AINN Layer2 (AIL2) raised undisclosed amount in a funding round from Waterdrip Capital, SatoshiLab, Foundinals Lab, Monday Capital, Bitrise Capital, Genblock Capital, AscendEX, Cipholio Ventures, AINN Labs, BitMart.

AINN Layer2 is a Bitcoin Layer2 solution designed with AI-driven modular construction, facilitating seamless cross-chain asset transfers between Bitcoin's Layer1 and Layer2. With features like the AI Protocol Controller managing registration, rewards, and network operations, and the AINN L2 token serving as the ecosystem's native currency and incentive mechanism, it offers a secure and efficient platform for decentralized asset management and exchange.

AINN Layer2 is a Bitcoin Layer2 solution designed with AI-driven modular construction, facilitating seamless cross-chain asset transfers between Bitcoin's Layer1 and Layer2. With features like the AI Protocol Controller managing registration, rewards, and network operations, and the AINN L2 token serving as the ecosystem's native currency and incentive mechanism, it offers a secure and efficient platform for decentralized asset management and exchange.

GAM3S GG (ex Polkastarter Gaming) raised $2M in a Strategic funding round from Merit Circle, WWVentures, Cogitent Ventures, P2 Ventures (Polygon Ventures), Cypher Capital, Acheron Trading, Basics Capital, OIG Capital (Oracles Investment Group), BreederDAO, Metabros, HerculesDAO, Sandeep Nailwal, Gabby Dizon.

GAM3S GG is a Web3 gaming superapp that not only offers curated content and reviews for over 350 games but also introduces users to the world of blockchain-powered gaming. With its native token, $G3, users can stake for rights to exclusive privileges, redeem tokens for seasonal rewards, and engage in platform transactions, tournaments, and marketplace trading.

GAM3S GG is a Web3 gaming superapp that not only offers curated content and reviews for over 350 games but also introduces users to the world of blockchain-powered gaming. With its native token, $G3, users can stake for rights to exclusive privileges, redeem tokens for seasonal rewards, and engage in platform transactions, tournaments, and marketplace trading.

Botto raised $1.7M in a funding round from 1kx*, Collab+Currency, Variant Fund.

Botto is a generative artist governed by the community. Botto creates 350 art pieces a week and presents them to the community. These art pieces are considered a 'round', whereby individual art pieces are denoted as 'fragments'.

Botto is a generative artist governed by the community. Botto creates 350 art pieces a week and presents them to the community. These art pieces are considered a 'round', whereby individual art pieces are denoted as 'fragments'.

KiloEx raised undisclosed amount in a funding round from Foresight Ventures.

KiloEx is the next generation of user-friendly perpetual DEX focused on risk management and capital efficiency. Its platform offers lightning-fast trades and an intuitive trading experience with a wide range of trading pairs, while offering liquidity providers risk-neutral positions and LP-friendly solutions.

KiloEx is the next generation of user-friendly perpetual DEX focused on risk management and capital efficiency. Its platform offers lightning-fast trades and an intuitive trading experience with a wide range of trading pairs, while offering liquidity providers risk-neutral positions and LP-friendly solutions.

Nebula Revelation raised undisclosed amount in a funding round from DWF Labs, Waterdrip Capital, Central Research, Stratified Capital, CapsuleX Labs.

Nebula Revelation is a Web3 space-themed open-world game, committed to creating a sustainable sandbox universe where gameplay and the Web3 economy coexist harmoniously. It integrates gameplay and Web3 features seamlessly, ensuring a long-term immersive experience for players while utilizing AI technology to enrich NPC behavior and game dynamics. Nebula Revelation maintains community long-term incentives and contributions to game content through in-game UGC (NFT Assembler), out-of-game UGC (NFT Maker), and voting (Vote-Driven).

Nebula Revelation is a Web3 space-themed open-world game, committed to creating a sustainable sandbox universe where gameplay and the Web3 economy coexist harmoniously. It integrates gameplay and Web3 features seamlessly, ensuring a long-term immersive experience for players while utilizing AI technology to enrich NPC behavior and game dynamics. Nebula Revelation maintains community long-term incentives and contributions to game content through in-game UGC (NFT Assembler), out-of-game UGC (NFT Maker), and voting (Vote-Driven).

Bit islands (Bi social) raised $3M in a funding round from Web3Vision, WAGMI Ventures, QF Capital.

Bit islands is the creator of Bi social, a decentralized social trading protocol. Bi social is a pioneering Web3 platform that facilitates social trading, allowing users to discover trading signals, follow experienced traders, and engage in trading activities through decentralized applications. With components like Bi Space for user profiles and Bi Feed for personalized content, along with decentralized identity services like Bi DID, Bi social enhances the user experience within the Web3 ecosystem.

Bit islands is the creator of Bi social, a decentralized social trading protocol. Bi social is a pioneering Web3 platform that facilitates social trading, allowing users to discover trading signals, follow experienced traders, and engage in trading activities through decentralized applications. With components like Bi Space for user profiles and Bi Feed for personalized content, along with decentralized identity services like Bi DID, Bi social enhances the user experience within the Web3 ecosystem.

Tanssi Network raised $6M in a Strategic funding round from Scytale Digital, KR1 plc, SNZ Holding, Arrington Capital, Blockchain Founders Fund, Cogitent Ventures, Borderless Capital, Cross-Chain Ecosystem Fund, Hypersphere, Gavin Wood.

Tanssi is an appchain infrastructure protocol developed by Moondance Labs, aiming to simplify and accelerate appchain deployment for developers. It provides permissionless and developer-friendly infrastructure tools and services, eliminating the complexities of traditional blockchain implementation. With the added benefits of shared security and interoperability from the Polkadot relay chain, Tanssi bridges the gap between developers and the appchain development ecosystem.

Tanssi is an appchain infrastructure protocol developed by Moondance Labs, aiming to simplify and accelerate appchain deployment for developers. It provides permissionless and developer-friendly infrastructure tools and services, eliminating the complexities of traditional blockchain implementation. With the added benefits of shared security and interoperability from the Polkadot relay chain, Tanssi bridges the gap between developers and the appchain development ecosystem.

QnA3 AI raised undisclosed amount in a Grants funding round from Solana Foundation.

QnA3 AI is an AI-powered Web3 knowledge engine and intent-centric trading platform, providing a one-click gateway to the world of Web3 information. It empowers users to make informed cryptocurrency investment decisions by offering not only access to data but also sophisticated logical analysis capabilities. With features like extended query quotas, interactive question engagement, advertisement and sponsorship opportunities, incentives tied to trading functions, enhanced governance, and exclusive content access, QnA3 AI fosters a holistic community ecosystem, leveraging the GPT token for AI features and governance.

QnA3 AI is an AI-powered Web3 knowledge engine and intent-centric trading platform, providing a one-click gateway to the world of Web3 information. It empowers users to make informed cryptocurrency investment decisions by offering not only access to data but also sophisticated logical analysis capabilities. With features like extended query quotas, interactive question engagement, advertisement and sponsorship opportunities, incentives tied to trading functions, enhanced governance, and exclusive content access, QnA3 AI fosters a holistic community ecosystem, leveraging the GPT token for AI features and governance.

Espresso Systems raised $28M in a Series B funding round from Andreessen Horowitz (a16z crypto)*, P2 Ventures (Polygon Ventures), Taiko, O(1)Labs, Starkware, Offchain Labs.

Espresso is launching a standalone blockchain as well as a solution for Ethereum: Configurable Asset Privacy on Ethereum (CAPE), a privacy offering for both digital assets and associated transactions, particularly for stablecoins.

Espresso is launching a standalone blockchain as well as a solution for Ethereum: Configurable Asset Privacy on Ethereum (CAPE), a privacy offering for both digital assets and associated transactions, particularly for stablecoins.

Succinct Labs raised $55M in a Series A funding round from Paradigm*, Robot Ventures, Bankless Ventures, Geometry, Zero Knowledge Validator (ZKV), Elad Gil, Sreeram Kannan, Sandeep Nailwal, John Adler, Daniel Lubarov.

Succinct Labs is a company aimed at democratizing access to zero-knowledge proofs (ZKPs) for developers. SP1, their flagship project, is a high-performance, open-source zkVM (zero-knowledge virtual machine) that enables developers to write ZKPs using Rust, leveraging a decentralized prover network provided by Succinct for efficient proof generation with just one click. SP1 represents a significant advancement in the field, offering a performant and customizable zkVM solution that empowers developers to utilize ZKPs seamlessly in their projects, thereby revolutionizing the landscape of blockchain architectures and enhancing security and scalability.

Succinct Labs is a company aimed at democratizing access to zero-knowledge proofs (ZKPs) for developers. SP1, their flagship project, is a high-performance, open-source zkVM (zero-knowledge virtual machine) that enables developers to write ZKPs using Rust, leveraging a decentralized prover network provided by Succinct for efficient proof generation with just one click. SP1 represents a significant advancement in the field, offering a performant and customizable zkVM solution that empowers developers to utilize ZKPs seamlessly in their projects, thereby revolutionizing the landscape of blockchain architectures and enhancing security and scalability.

Eesee raised undisclosed amount in a funding round from Animoca Brands.

Eesee is an innovative gamified marketplace. It stands out with its unique raffle system, enabling sellers to creatively sell digital assets and reduce buy-side friction. The platform is tailored for digital assets, tokens, and real-world assets (RWAs). It allows sellers to create customized gamified drops, like decentralized on-chain raffles, and offers buyers action-based entry opportunities, aligning with the ethos of the crypto industry.

Eesee is an innovative gamified marketplace. It stands out with its unique raffle system, enabling sellers to creatively sell digital assets and reduce buy-side friction. The platform is tailored for digital assets, tokens, and real-world assets (RWAs). It allows sellers to create customized gamified drops, like decentralized on-chain raffles, and offers buyers action-based entry opportunities, aligning with the ethos of the crypto industry.

Asterix Labs raised undisclosed amount in a Strategic funding round from Hashed, Arcthecommunity (ARC), Arcane Group, DeFi Capital, Kahuna Ventures, Liquid X Ventures, Everest Ventures Group (EVG), Cryptonite Capital, Momentum 6 (M6), Coinseeker.

Asterix is a digital ownership platform that sets standards for the future, powered by DN404. DN404 is a contract linking a fungible ERC-20 token and a non-fungible ERC-721 token, ensuring actions on one contract are reflected on the other. The platform offers the $ASTX token and corresponding NFTs, with ownership mirrored between the two, and users can purchase them on various marketplaces like Opensea, Blur, and Opensea Pro.

Asterix is a digital ownership platform that sets standards for the future, powered by DN404. DN404 is a contract linking a fungible ERC-20 token and a non-fungible ERC-721 token, ensuring actions on one contract are reflected on the other. The platform offers the $ASTX token and corresponding NFTs, with ownership mirrored between the two, and users can purchase them on various marketplaces like Opensea, Blur, and Opensea Pro.

Castle of Blackwater raised $1M in a Strategic funding round from Metrics Ventures, 3Commas Capital, Faculty Group.

Castle of Blackwater is a Web3 2D social deduction game set in a fantasy medieval theme, where up to 15 players navigate secret factions with unique abilities, fostering deception and strategic gameplay. Castle of Blackwater developed in collaboration with Merit Circle, will be one of the first to launch on Beam. With a focus on player interaction, the game encourages analysis of actions, deduction of hidden roles, and the utilization of abilities to influence outcomes, promising an engaging and dynamic experience.

Castle of Blackwater is a Web3 2D social deduction game set in a fantasy medieval theme, where up to 15 players navigate secret factions with unique abilities, fostering deception and strategic gameplay. Castle of Blackwater developed in collaboration with Merit Circle, will be one of the first to launch on Beam. With a focus on player interaction, the game encourages analysis of actions, deduction of hidden roles, and the utilization of abilities to influence outcomes, promising an engaging and dynamic experience.

CoinMart raised $3M in a funding round from IDG Capital.

CoinMart is a Netherlands-based cryptocurrency platform dedicated to democratizing cryptocurrency investment and trading. With a focus on safety, security, and regulatory compliance, CoinMart offers accessible services with modest fees, aiming to simplify the trading process for users while ensuring their confidence and ease of participation.

CoinMart is a Netherlands-based cryptocurrency platform dedicated to democratizing cryptocurrency investment and trading. With a focus on safety, security, and regulatory compliance, CoinMart offers accessible services with modest fees, aiming to simplify the trading process for users while ensuring their confidence and ease of participation.

Cluster Protocol raised undisclosed amount in a funding round from Pivot.

Cluster Protocol is a proof-of-compute protocol and open-source community for decentralized AI models. It enables secure model training using private datasets through encryption and federated learning techniques, ensuring data localization and protection. With features like decentralized datasets, collaborative model training, and opportunities to earn passive income by contributing resources, Cluster Protocol aims to democratize GPU access, facilitate decentralized data sharing, lower computational barriers, and streamline model monetization for developers.

Cluster Protocol is a proof-of-compute protocol and open-source community for decentralized AI models. It enables secure model training using private datasets through encryption and federated learning techniques, ensuring data localization and protection. With features like decentralized datasets, collaborative model training, and opportunities to earn passive income by contributing resources, Cluster Protocol aims to democratize GPU access, facilitate decentralized data sharing, lower computational barriers, and streamline model monetization for developers.

ZKasino raised undisclosed amount in a Series A funding round from MEXC, Big Brain Holdings, 0xSisyphus, Trading axe, Pentoshi.

ZKasino is a decentralized crypto betting platform and blockchain casino that ensures fairness through on-chain verification, accepts wagers in cryptocurrencies directly from Web3 wallets, and offers various types of betting including casino games, PvP games, and sports betting. It aims to provide the most transparent and fair betting experience with the lowest house edge compared to other platforms, and future developments include decentralized bankroll pools, gasless bets, play-to-earn opportunities, and integration with gaming software providers.

ZKasino is a decentralized crypto betting platform and blockchain casino that ensures fairness through on-chain verification, accepts wagers in cryptocurrencies directly from Web3 wallets, and offers various types of betting including casino games, PvP games, and sports betting. It aims to provide the most transparent and fair betting experience with the lowest house edge compared to other platforms, and future developments include decentralized bankroll pools, gasless bets, play-to-earn opportunities, and integration with gaming software providers.

MANTRA raised $11M in a funding round from Shorooq Partners*, Three Point, Forte Securities, Virtuzone, Hex Trust, GameFi Ventures, Caladan, Token Bay Capital, BlackPine, Mapleblock Capital, Fuse Capital, 280 Capital.

MANTRA is a Middle East-focused project securing licensures from Dubai's crypto regulator VARA, targeting the crypto-native community. It aims to fill a gap in the Cosmos ecosystem by creating a chain of regulated digital assets for users valuing regulatory compliance. Built on Cosmos SDK and Tendermint consensus, MANTRA offers a permissionless blockchain for developing Web3 applications in a regulated and compliant environment.

MANTRA is a Middle East-focused project securing licensures from Dubai's crypto regulator VARA, targeting the crypto-native community. It aims to fill a gap in the Cosmos ecosystem by creating a chain of regulated digital assets for users valuing regulatory compliance. Built on Cosmos SDK and Tendermint consensus, MANTRA offers a permissionless blockchain for developing Web3 applications in a regulated and compliant environment.

GRVT raised $2.2M in a Strategic funding round from Selini Capital, Pulsar, Ampersan.

GRVT (Gravity) is a hybrid exchange platform designed for institutional investors, offering both the user experience of centralized exchanges (CEX) and the security of decentralized exchanges (DEX). It prioritizes lower latency, scalability, and user privacy while implementing strict regulatory compliance (KYC & AML).

GRVT (Gravity) is a hybrid exchange platform designed for institutional investors, offering both the user experience of centralized exchanges (CEX) and the security of decentralized exchanges (DEX). It prioritizes lower latency, scalability, and user privacy while implementing strict regulatory compliance (KYC & AML).

HyperPlay raised undisclosed amount in a funding round from SQUARE ENIX.

HyperPlay is a web3-native game launcher that enables players to carry their wallet, NFTs, tokens, and achievements into every game. By tackling the challenge of Web3 gaming interoperability, HyperPlay enables developers to work without relying on centralized entities, while also offering a range of Web3 titles and monetization options without imposing taxes on in-game economies.

HyperPlay is a web3-native game launcher that enables players to carry their wallet, NFTs, tokens, and achievements into every game. By tackling the challenge of Web3 gaming interoperability, HyperPlay enables developers to work without relying on centralized entities, while also offering a range of Web3 titles and monetization options without imposing taxes on in-game economies.

Gull Network raised undisclosed amount in a funding round from Banter Capital, Genesis Block Ventures Capital (GBV), Ozaru Ventures, BoxMining, SVC, x21 Digital, Onemax Capital, Basics Capital, Raptor Capital, Momentum 6 (M6), Maven Capital, Magnus Capital.

Gull Network is the Layer 3 solution for token launches, powered by Manta Network, offering code-less pools, customizable tokens, and liquidity protection against snipers. It simplifies tokenization and DeFi engagement with intuitive smart contracts, revolutionizing DeFi by enabling effortless meme creation and trading without coding. Gull Network streamlines crypto tokenization, providing a user-friendly platform for launching digital assets seamlessly, catering to both novice and experienced users alike.

Gull Network is the Layer 3 solution for token launches, powered by Manta Network, offering code-less pools, customizable tokens, and liquidity protection against snipers. It simplifies tokenization and DeFi engagement with intuitive smart contracts, revolutionizing DeFi by enabling effortless meme creation and trading without coding. Gull Network streamlines crypto tokenization, providing a user-friendly platform for launching digital assets seamlessly, catering to both novice and experienced users alike.

Dolomite raised $0.9M in a Strategic funding round from Optic Capital, Sandeep Nailwal, DCF God, Marc Boiron, DeFiDad, Soby, Altcoin Sherpa, Pentoshi.

Dolomite is a decentralized exchange (DEX) and money market protocol that operates on the Arbitrum Ethereum layer 2 network developed by Leavitt Innovations, the lead developer of next-generation DeFi money market. It offers trustless trade settlement, overcollateralized loans, margin trading, and on-chain liquidity through automated market maker (AMM) pools.

Dolomite is a decentralized exchange (DEX) and money market protocol that operates on the Arbitrum Ethereum layer 2 network developed by Leavitt Innovations, the lead developer of next-generation DeFi money market. It offers trustless trade settlement, overcollateralized loans, margin trading, and on-chain liquidity through automated market maker (AMM) pools.

Tokenize Xchange raised $11.5M in a Series A funding round from TRIVE Ventures.

Tokenize Xchange is a centralized cryptocurrency exchange based in Singapore, providing a secure platform for trading digital assets with competitive fees. The exchange offers the Tokenize Crypto Earn program, allowing users to deposit cryptocurrencies and earn monthly interest in TKX tokens, enhancing the earning potential of their crypto holdings.

Tokenize Xchange is a centralized cryptocurrency exchange based in Singapore, providing a secure platform for trading digital assets with competitive fees. The exchange offers the Tokenize Crypto Earn program, allowing users to deposit cryptocurrencies and earn monthly interest in TKX tokens, enhancing the earning potential of their crypto holdings.

CarrieVerse raised undisclosed amount in a funding round from Alpha Token Capital.

CarrieVerse is a blockchain-based metaverse platform where users can immerse themselves in a virtual reality world alongside Carrie and her friends, engaging in various activities and experiences. It offers a space for social interaction, gaming, education, and economic activities, allowing users to earn utility tokens while expressing their personality through customizable avatars. With features like social media integration, users can connect with others globally, make friends, and participate in virtual events, fostering a vibrant and dynamic virtual community.

CarrieVerse is a blockchain-based metaverse platform where users can immerse themselves in a virtual reality world alongside Carrie and her friends, engaging in various activities and experiences. It offers a space for social interaction, gaming, education, and economic activities, allowing users to earn utility tokens while expressing their personality through customizable avatars. With features like social media integration, users can connect with others globally, make friends, and participate in virtual events, fostering a vibrant and dynamic virtual community.

Kemet Trading raised $5M in a funding round from Further Ventures*, Deribit, QCP Capital, FalconX, Hyperithm, C² Ventures, Flow Traders, Beco Capital.

Kemet Trading is a provider of institutional-grade infrastructure for digital asset derivative trading, offering a single access point for optimized trading experiences across various liquidity venues. With a focus on enhancing trading capabilities and market liquidity, Kemet's technology facilitates seamless access to liquidity, data, trade execution, and post-trade workflows for institutional players. As a pure technology offering, Kemet does not assume counterparty risk and allows customers to independently negotiate arrangements with liquidity providers and other parties.

Kemet Trading is a provider of institutional-grade infrastructure for digital asset derivative trading, offering a single access point for optimized trading experiences across various liquidity venues. With a focus on enhancing trading capabilities and market liquidity, Kemet's technology facilitates seamless access to liquidity, data, trade execution, and post-trade workflows for institutional players. As a pure technology offering, Kemet does not assume counterparty risk and allows customers to independently negotiate arrangements with liquidity providers and other parties.

XPLA (ex C2X) raised undisclosed amount in a funding round from Builder Capital.

XPLA is a blockchain platform focused on gaming, content, and entertainment. It leverages partnerships with Web 2 content providers to overcome the cold start problem and aims to create an ecosystem of media content while ensuring compatibility with Ethereum-based blockchain and decentralized applications.

XPLA is a blockchain platform focused on gaming, content, and entertainment. It leverages partnerships with Web 2 content providers to overcome the cold start problem and aims to create an ecosystem of media content while ensuring compatibility with Ethereum-based blockchain and decentralized applications.

Entangle raised undisclosed amount in a funding round from ConsenSys.

Entangle is a customizable messaging infrastructure designed for Web3, offering secure, interoperable data storage on the blockchain, empowering builders to create unique cross-chain applications and optimize ecosystem liquidity.

Entangle is a customizable messaging infrastructure designed for Web3, offering secure, interoperable data storage on the blockchain, empowering builders to create unique cross-chain applications and optimize ecosystem liquidity.

Juice Finance (Omega) raised $1M in a funding round from Delphi Digital, DWF Ventures, Spencer Ventures, Cypher Capital, Arthur Hayes, dingaling, Cozomo de’ Medici, Icedcoffee, 0xbrent.

Juice Finance is a cross-margin DeFi platform operating on Blast's Layer 2 infrastructure developed by Omega team, focused on building decentralized infrastructure to revolutionize omnichain and Bitcoin DeFi. Juice Finance offers innovative lending capabilities using Blast's native rebasing tokens. It enables users to access up to 3x leverage for yield and point farming activities within the Blast ecosystem, aiming to optimize rewards and APY opportunities.

Juice Finance is a cross-margin DeFi platform operating on Blast's Layer 2 infrastructure developed by Omega team, focused on building decentralized infrastructure to revolutionize omnichain and Bitcoin DeFi. Juice Finance offers innovative lending capabilities using Blast's native rebasing tokens. It enables users to access up to 3x leverage for yield and point farming activities within the Blast ecosystem, aiming to optimize rewards and APY opportunities.

Flash Protocol raised undisclosed amount in a Private funding round from Signum Capital, DWF Labs, Cypher Capital, Cogitent Ventures, Rarestone Capital, Pentos Ventures, Portico Ventures, Innovion, Portal.

Flash Protocol is a decentralized protocol operating on the Bitcoin blockchain, facilitating the issuance and management of Taproot Assets and NFTs directly on Bitcoin, thereby expanding the network's capabilities. It aims to enhance liquidity through a dedicated marketplace and contribute to the emerging trend of Bitcoin DeFi by offering functionalities such as staking and lending for Bitcoin users.

Flash Protocol is a decentralized protocol operating on the Bitcoin blockchain, facilitating the issuance and management of Taproot Assets and NFTs directly on Bitcoin, thereby expanding the network's capabilities. It aims to enhance liquidity through a dedicated marketplace and contribute to the emerging trend of Bitcoin DeFi by offering functionalities such as staking and lending for Bitcoin users.

Bitbrand raised $500K in a funding round from Hustle Fund, Side Door Ventures, GFR Fund.

Bitbrand is a platform offering blockchain-certified luxury digital products with tangible utility, seamlessly blending tradition and innovation. Collaborating with prestigious fashion houses and artists, Bitbrand creates exclusive Apple Watch faces verified through blockchain technology for authenticity. It aims to bridge the luxury design with smart technology, providing users with a digital experience.

Bitbrand is a platform offering blockchain-certified luxury digital products with tangible utility, seamlessly blending tradition and innovation. Collaborating with prestigious fashion houses and artists, Bitbrand creates exclusive Apple Watch faces verified through blockchain technology for authenticity. It aims to bridge the luxury design with smart technology, providing users with a digital experience.

NMKR raised undisclosed amount in a funding round from Emurgo Ventures.

NMKR is a Cardano-based NFT and tokenization service provider focused on empowering ventures in the digital asset space. With cutting-edge solutions and user-friendly tools, NMKR aims to simplify the creation and management of NFTs and real-world asset tokenization projects, driven by a dedicated mission to assist artists, brands, and developers in leveraging blockchain technology. As a globally distributed team, NMKR prioritizes efficiency and innovation, fostering collaboration to advance the tokenization of real-world assets and accelerate blockchain adoption.

NMKR is a Cardano-based NFT and tokenization service provider focused on empowering ventures in the digital asset space. With cutting-edge solutions and user-friendly tools, NMKR aims to simplify the creation and management of NFTs and real-world asset tokenization projects, driven by a dedicated mission to assist artists, brands, and developers in leveraging blockchain technology. As a globally distributed team, NMKR prioritizes efficiency and innovation, fostering collaboration to advance the tokenization of real-world assets and accelerate blockchain adoption.

* fund, that lead investment round

Telegram

Telegram