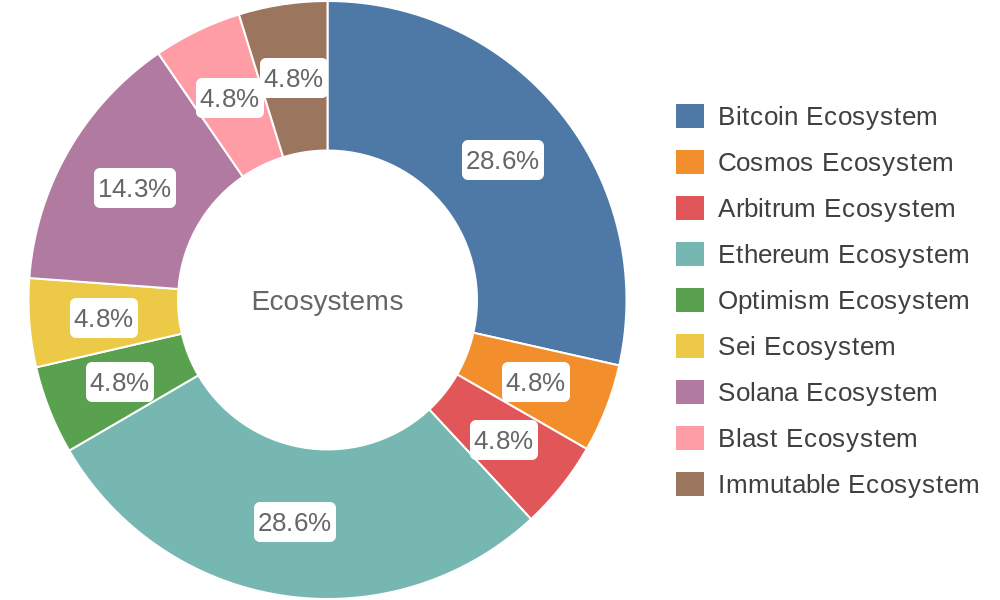

This week's biggest funding round

Berachain raised $69M in a funding round from Brevan Howard Digital*, Framework Ventures*.

Berachain is a DeFi focused EVM-compatible Layer 1 blockchain built on the Cosmos SDK, powered by Proof of Liquidity Consensus and will be EVM compatible. The project aims to allow users to stake tokens while providing liquidity to DeFi protocols in parallel. Berachain has a tri-token system of bera (the native gas token), honey (a native stablecoin) and BGT (the "non-transferrable" Bera Governance Token).

Berachain is a DeFi focused EVM-compatible Layer 1 blockchain built on the Cosmos SDK, powered by Proof of Liquidity Consensus and will be EVM compatible. The project aims to allow users to stake tokens while providing liquidity to DeFi protocols in parallel. Berachain has a tri-token system of bera (the native gas token), honey (a native stablecoin) and BGT (the "non-transferrable" Bera Governance Token).

Pre-seed and Seed investment rounds

Ordify raised $2M in a Seed funding round from QU Ventures*, Oddiyana Ventures, Maven Capital, Seedify, Nabais Capital, Three M Capital, FounderHeads VC, Brilliance Ventures, Gains Associates, Genesis Capital, Autonomy Capital, ChainGPT.

Ordify is a suite of blockchain products designed to enhance investment experiences, including a Launchpad, Bridge, and Wallet. Its primary focus is on facilitating growth within the emerging Bitcoin ecosystem while also providing compatibility with EVM chains like Ethereum, BSC, and Polygon, enabling users to invest in various projects across multiple networks. The ORFY Bridge stands out as a pioneering solution, allowing seamless token transfer between the BTC native chain and Ethereum, while the Ordify wallet offers secure storage for tokens, NFTs, and Ordinals, with support for Taproot, ERC20, and EVM chains.

Ordify is a suite of blockchain products designed to enhance investment experiences, including a Launchpad, Bridge, and Wallet. Its primary focus is on facilitating growth within the emerging Bitcoin ecosystem while also providing compatibility with EVM chains like Ethereum, BSC, and Polygon, enabling users to invest in various projects across multiple networks. The ORFY Bridge stands out as a pioneering solution, allowing seamless token transfer between the BTC native chain and Ethereum, while the Ordify wallet offers secure storage for tokens, NFTs, and Ordinals, with support for Taproot, ERC20, and EVM chains.

R Games raised $500K in a Seed funding round from Oddiyana Ventures, FundLand Capital, QU Ventures, BMW Capital, Ferreum Network, Labs Group.

R Games is a Web3 gaming studio developed racing game aims to revolutionize gaming by integrating blockchain technology. With a focus on play-to-earn mechanics, players may earn digital rewards like cryptocurrency or NFTs while enjoying traditional gaming elements. Their forward-looking roadmap includes plans for augmented and virtual reality integration, signaling a commitment to a future-proof gaming platform despite being in the early stages of development.

R Games is a Web3 gaming studio developed racing game aims to revolutionize gaming by integrating blockchain technology. With a focus on play-to-earn mechanics, players may earn digital rewards like cryptocurrency or NFTs while enjoying traditional gaming elements. Their forward-looking roadmap includes plans for augmented and virtual reality integration, signaling a commitment to a future-proof gaming platform despite being in the early stages of development.

Avalon Finance raised undisclosed amount in a Seed funding round from SNZ Holding, Summer Ventures, Spark Digital Capital, Matrixdock, Web3Port Labs.

Avalon Finance is a decentralized lending protocol built on Merlin Chain, comprising three main components: overcollateralized lending, derivatives trading, and an algorithmic stablecoin. It operates within a framework emphasizing user control and compliance with regulatory requirements, ensuring transparency and security. Users retain ownership and control over their assets, with the platform providing a range of services, including access to information and resources while adhering to legal standards and best practices.

Avalon Finance is a decentralized lending protocol built on Merlin Chain, comprising three main components: overcollateralized lending, derivatives trading, and an algorithmic stablecoin. It operates within a framework emphasizing user control and compliance with regulatory requirements, ensuring transparency and security. Users retain ownership and control over their assets, with the platform providing a range of services, including access to information and resources while adhering to legal standards and best practices.

Range raised $2.7M in a Seed funding round from Galileo*, Robot Ventures, Volt Capital, Chorus One, Bitscale Capital, Fenbushi Capital, Monoceros Ventures, Reverie, Informal Systems, Caballeros Capital, Kahuna Ventures, Xavier Meegan, Maghnus Mareneck, Luis Cuende, Sawit Trisirisatayawong.

Range is a security and risk platform tailored for blockchains and rollups, offering enterprise-grade infrastructure to address security concerns across various blockchain ecosystems and bridges. With a focus on real-time monitoring and alerting, Range ensures heightened security for personal wallets, smart contracts, and the broader multi-chain/rollup landscape.

Range is a security and risk platform tailored for blockchains and rollups, offering enterprise-grade infrastructure to address security concerns across various blockchain ecosystems and bridges. With a focus on real-time monitoring and alerting, Range ensures heightened security for personal wallets, smart contracts, and the broader multi-chain/rollup landscape.

BitRealms raised undisclosed amount in a Pre-seed funding round from Comma3 Ventures*, BitValue Capital, BIT Asia, Big Brain Holdings, Negentropy Capital, BSCS.

BitRealms is the open metaverse social gaming platform within the Bitcoin ecosystem, leveraging Bitcoin's Layer 2. Central to BitRealms is its vibrant community, where inscription holders actively contribute to shaping the platform's digital utopia and enjoy early access benefits. With a focus on fair participation and launch, BitRealms offers a diverse range of gaming experiences, from intense PVE battles to engaging PVP matchups and rich social interactions, all underpinned by its unique inscription system.

BitRealms is the open metaverse social gaming platform within the Bitcoin ecosystem, leveraging Bitcoin's Layer 2. Central to BitRealms is its vibrant community, where inscription holders actively contribute to shaping the platform's digital utopia and enjoy early access benefits. With a focus on fair participation and launch, BitRealms offers a diverse range of gaming experiences, from intense PVE battles to engaging PVP matchups and rich social interactions, all underpinned by its unique inscription system.

mmERCH raised $6.4M in a Seed funding round from Liberty City Ventures*, 6529 Capital, Christie’s, Flamingo, Red Dao.

mmERCH is a blockchain-based fashion startup that merges digital and physical fashion through generative design, offering unique garments with corresponding digital twins. Leveraging blockchain technology, mmERCH creates limited-edition, verifiable digital assets linked to high-quality physical clothing, fostering evolving digital fashion experiences for personalized expression in both the digital and physical realms. With a focus on collaboration and premium craftsmanship, mmERCH partners with artists and brands to deliver diverse styles and artistic expressions in each clothing drop.

mmERCH is a blockchain-based fashion startup that merges digital and physical fashion through generative design, offering unique garments with corresponding digital twins. Leveraging blockchain technology, mmERCH creates limited-edition, verifiable digital assets linked to high-quality physical clothing, fostering evolving digital fashion experiences for personalized expression in both the digital and physical realms. With a focus on collaboration and premium craftsmanship, mmERCH partners with artists and brands to deliver diverse styles and artistic expressions in each clothing drop.

SHUI raised undisclosed amount in a Seed funding round from BlockBooster*, Conflux Network.

SHUI is a Liquid Staking Protocol on Conflux, enabling users to earn rewards seamlessly without locking their CFX tokens. By participating in SHUI, users can securely earn rewards on their Conflux tokens while maintaining liquidity and flexibility in their holdings.

SHUI is a Liquid Staking Protocol on Conflux, enabling users to earn rewards seamlessly without locking their CFX tokens. By participating in SHUI, users can securely earn rewards on their Conflux tokens while maintaining liquidity and flexibility in their holdings.

Eyris raised $3M in a Pre-seed funding round from Red Cell Partners.

Eyris is a secure, private blockchain platform enabling decentralized technology adoption with tamper-proof data storage. It offers a cloud-, device-, and encryption-agnostic solution, ensuring data ownership and control, while providing robust identity and access management features. Eyris serves government and commercial sectors, offering zero-trust architecture, scalability, customizable plugins, cyberattack mitigation, and immutable transaction logs, reinforcing data security and integrity.

Eyris is a secure, private blockchain platform enabling decentralized technology adoption with tamper-proof data storage. It offers a cloud-, device-, and encryption-agnostic solution, ensuring data ownership and control, while providing robust identity and access management features. Eyris serves government and commercial sectors, offering zero-trust architecture, scalability, customizable plugins, cyberattack mitigation, and immutable transaction logs, reinforcing data security and integrity.

Munchables raised undisclosed amount in a Pre-seed funding round from Manifold*, Mechanism Capital*, Selini Capital, Eden Holdings (ED3N Ventures), 3Commas, One Block Capital Advisory, Hidden Street Capital, Duplicate Capital, Jordi Alexander, CBB0FE, 0xLawliette, Casey K. Caruso, Andrew Kang, dingaling, DCF God, Bharat Krymo, Hype.eth, Danish Chaudhry.

Munchables is a GameFi universe based on Blast where players embark on a mission to save the adorable Munchables and restore reality. Players can level up their unique pocket-sized creatures, socialize across Snuggeries, and stake Blast ETH and USDB to unlock their Munchables, all while enjoying a fair playing field and earning points for attention and early participation.

Munchables is a GameFi universe based on Blast where players embark on a mission to save the adorable Munchables and restore reality. Players can level up their unique pocket-sized creatures, socialize across Snuggeries, and stake Blast ETH and USDB to unlock their Munchables, all while enjoying a fair playing field and earning points for attention and early participation.

ClearToken raised $10M in a Seed funding round from Laser Digital, Nomura, Flow Traders, GSR Markets LTD, LMAX Digital, Zodia Custody.

ClearToken is a digital asset trading platform introducing a clearing house to reduce counterparty risk and enhance institutional adoption. The platform is establishing a Central Counterparty (CCP) to centralize clearing, settlement, collateral, and risk management for digital asset transactions, providing a streamlined and risk-reduced environment for investors, exchanges, brokers, market makers, and custodians.

ClearToken is a digital asset trading platform introducing a clearing house to reduce counterparty risk and enhance institutional adoption. The platform is establishing a Central Counterparty (CCP) to centralize clearing, settlement, collateral, and risk management for digital asset transactions, providing a streamlined and risk-reduced environment for investors, exchanges, brokers, market makers, and custodians.

Fjord Foundry raised $4.3M in a Seed funding round from Lemniscap*, Mechanism Capital, Zee Prime Capital, NxGen, Castle Capital.

Fjord Foundry is a community-focused platform connecting innovative projects with engaged backers, specializing in fair and transparent Liquidity Bootstrapping Pools (LBPs). Their mission is to democratize access to early-stage opportunities, allowing project teams to bootstrap liquidity seamlessly while backers explore diverse opportunities aligned with their passions.

Fjord Foundry is a community-focused platform connecting innovative projects with engaged backers, specializing in fair and transparent Liquidity Bootstrapping Pools (LBPs). Their mission is to democratize access to early-stage opportunities, allowing project teams to bootstrap liquidity seamlessly while backers explore diverse opportunities aligned with their passions.

Trex20 raised $1M in a Seed funding round from Moonrock Capital, Marshland Capital, NxGen, x21 Digital, Oddiyana Ventures, Triple Gem Capital, Nabais Capital.

TREX20 is a GameFi platform built on the Bitcoin Protocol, offering multiple games, an NFTFi Marketplace, and a progressive lotto all within a single ecosystem. It represents an innovative approach to combining gaming, decentralized finance, and NFT trading on the Bitcoin blockchain.

TREX20 is a GameFi platform built on the Bitcoin Protocol, offering multiple games, an NFTFi Marketplace, and a progressive lotto all within a single ecosystem. It represents an innovative approach to combining gaming, decentralized finance, and NFT trading on the Bitcoin blockchain.

Bluwhale raised $7M in a Seed funding round from SBI Holdings*, Cardano, Momentum 6 (M6), Primal Capital, NxGen, Ghaf Capital Partners, Spyre Capital, Baselayer Capital, Haseeb Qureshi, Charles Huang, Jack McCauley.

Bluwhale is a decentralized AI personalization protocol for blockchains, revolutionizing digital communication by empowering wallet holders with control over their digital profiles and the ability to monetize their information. Through AI and contextual data, Bluwhale creates detailed wallet personas, allowing companies to target potential audiences more precisely, enhance user engagement, and bring transparency to the industry while rewarding users for their participation.

Bluwhale is a decentralized AI personalization protocol for blockchains, revolutionizing digital communication by empowering wallet holders with control over their digital profiles and the ability to monetize their information. Through AI and contextual data, Bluwhale creates detailed wallet personas, allowing companies to target potential audiences more precisely, enhance user engagement, and bring transparency to the industry while rewarding users for their participation.

Kaskade Finance raised undisclosed amount in a Pre-seed funding round from Marshland Capital, NxGen, Artemis Capital, Andromeda Capital, HerculesDAO, 369 Capital, Crypto Oasis, Virtual Bacon, Brian D Evans, CryptoJack.

Kaskade Finance is a cross-chain incentivization layer and gamified protocol that addresses liquidity bootstrapping in DeFi networks. By incentivizing trading volume, Kaskade increases liquidity in pools, providing protocols with a mechanism to engage users and enhance liquidity. Through campaigns on the Kaskade application, protocols offer rewards to users for increasing trading volume, fostering liquidity growth across various networks.

Kaskade Finance is a cross-chain incentivization layer and gamified protocol that addresses liquidity bootstrapping in DeFi networks. By incentivizing trading volume, Kaskade increases liquidity in pools, providing protocols with a mechanism to engage users and enhance liquidity. Through campaigns on the Kaskade application, protocols offer rewards to users for increasing trading volume, fostering liquidity growth across various networks.

Blockus raised $4M in a Pre-seed funding round from Maple VC*, Altos Ventures, ArkStream Capital, Eterna Capital, GFR Fund, MH Ventures, Orange DAO, Press Start Capital, WAGMI Ventures, Zephyrus Capital, Zhuoxun Yin, Michael Ma, Bryan Pelligrino.

Blockusis the web3 gaming platform provides compliant and seamlessly integrated wallet-as-a-service, whitelabel NFT marketplace, and fiat and crypto payments for games.

Blockusis the web3 gaming platform provides compliant and seamlessly integrated wallet-as-a-service, whitelabel NFT marketplace, and fiat and crypto payments for games.

Other investment rounds

Meson Network raised undisclosed amount in a funding round from OKX Ventures (ex OKEx Blockdream Ventures).

Meson Network is a decentralized network known for its "DePIN" project, which has gained substantial support from a community of 340,000 miners. With over 100,000 active nodes in 150 countries and a bandwidth capacity of approximately 20 Tb/s, Meson Network facilitates decentralized infrastructure networks, offering user-friendly technology for various hardware and establishing an economic cycle connecting idle resources with business demand.

Meson Network is a decentralized network known for its "DePIN" project, which has gained substantial support from a community of 340,000 miners. With over 100,000 active nodes in 150 countries and a bandwidth capacity of approximately 20 Tb/s, Meson Network facilitates decentralized infrastructure networks, offering user-friendly technology for various hardware and establishing an economic cycle connecting idle resources with business demand.

Aevo raised undisclosed amount in a funding round from Pantera Capital.

Aevo is a decentralized options exchange platform specializing in cryptocurrency options and perpetual contracts, providing a professional and high-performance trading experience. With features like margin trading and various option expiries, Aevo caters to experienced traders while ensuring security through its Ethereum blockchain foundation. Currently in closed beta, Aevo plans to launch its public mainnet in 2024, offering broader access to options and perpetual contract trading with a combination of off-chain order matching and on-chain settlements.

Aevo is a decentralized options exchange platform specializing in cryptocurrency options and perpetual contracts, providing a professional and high-performance trading experience. With features like margin trading and various option expiries, Aevo caters to experienced traders while ensuring security through its Ethereum blockchain foundation. Currently in closed beta, Aevo plans to launch its public mainnet in 2024, offering broader access to options and perpetual contract trading with a combination of off-chain order matching and on-chain settlements.

Jambo raised undisclosed amount in a funding round from Waterdrip Capital.

Africa-focused one-stop mobile application for multiple services such as ride-hailing, banking, communication and food delivery.

Africa-focused one-stop mobile application for multiple services such as ride-hailing, banking, communication and food delivery.

Ten (Obscuro Labs) raised $9M in a funding round from R3*, Republic Crypto, KuCoin Labs, Big Brain Holdings, DWF Labs.

Ten is a layer 2 solution for Ethereum, providing privacy and scalability through programmable encryption, allowing developers to decide the level of privacy for inputs, contract states, and executions. Incubated by global enterprise software firm R3, Ten stands out for its speed, affordability, seamless integration with existing Ethereum tools, and the unique feature of eliminating negative Maximal Extractable Value (MEV) across decentralized applications (dApps).

Ten is a layer 2 solution for Ethereum, providing privacy and scalability through programmable encryption, allowing developers to decide the level of privacy for inputs, contract states, and executions. Incubated by global enterprise software firm R3, Ten stands out for its speed, affordability, seamless integration with existing Ethereum tools, and the unique feature of eliminating negative Maximal Extractable Value (MEV) across decentralized applications (dApps).

PolyHedra Network raised $20M in a Strategic funding round from Polychain Capital*, Animoca Brands, Hashkey Capital, LongHash Ventures, Emirates Consortium, Mapleblock Capital, UOB Venture Management, Symbolic Capital (ex Hyperedge Capital), MH Ventures, ArkStream Capital.

PolyHedra is an infrastructure for Web3 Interoperability with cutting-edge zero-knowledge proof systems. It has developed several infrastructure offerings: ZK bridge (zkBridge) solution to send assets between web2 and web3 systems; a ZK decentralized identity solution (zkDID), a scalability solution, using a large-scale distributed proof generation network called ParaPlonk, to accelerate ZK rollups; design space for Web3 through highly scalable middlewares including ZK-NFT containers.

PolyHedra is an infrastructure for Web3 Interoperability with cutting-edge zero-knowledge proof systems. It has developed several infrastructure offerings: ZK bridge (zkBridge) solution to send assets between web2 and web3 systems; a ZK decentralized identity solution (zkDID), a scalability solution, using a large-scale distributed proof generation network called ParaPlonk, to accelerate ZK rollups; design space for Web3 through highly scalable middlewares including ZK-NFT containers.

Pallet Exchange raised $2.5M in a Private funding round from The Spartan Group, Symbolic Capital (ex Hyperedge Capital), Joe McCann, Cypher Capital, Spencer Ventures, 2 Punks Capital, Metabros, Genesis Block Ventures Capital (GBV), Gm Capital, Gmoney, Beanie, Iced Knife, Wizard of Soho.

Pallet Exchange is an NFT exchange on web3 built on Sei. Pallet aims to enhance the NFT trading experience by addressing issues related to gas and transaction speeds at the marketplace level, leveraging Sei's fast speeds at the L1 layer. Pallet has 2 million unique visitors and over $20 million in trading volume.

Pallet Exchange is an NFT exchange on web3 built on Sei. Pallet aims to enhance the NFT trading experience by addressing issues related to gas and transaction speeds at the marketplace level, leveraging Sei's fast speeds at the L1 layer. Pallet has 2 million unique visitors and over $20 million in trading volume.

Clique raised $8M in a Series A funding round from Polychain Capital*, Robot Ventures, Bankless Ventures, Cyber Fund, Offchain Labs, Zero Knowledge Validator (ZKV), Balaji Srinivasan, Sandeep Nailwal, Santiago R. Santos, Calvin Liu, Uma Roy, Yi Sun, Sandy Peng, Gabby Dizon, George Lambeth, Scott Moore, Smokey The Bera, Cygaar.

Clique is a compute coordination layer that optimizes the allocation of computational resources for smart contracts and general applications through an auction-based system. It caters to diverse needs, from blockchain-based contracts to conventional cloud services, ensuring efficient resource matching. Leveraging game theory, Clique incentivizes fair play among providers, creating a competitive marketplace for transparent and cost-effective resource allocation.

Clique is a compute coordination layer that optimizes the allocation of computational resources for smart contracts and general applications through an auction-based system. It caters to diverse needs, from blockchain-based contracts to conventional cloud services, ensuring efficient resource matching. Leveraging game theory, Clique incentivizes fair play among providers, creating a competitive marketplace for transparent and cost-effective resource allocation.

Nyan Heroes raised $3M in a Strategic funding round from Mechanism Capital*, Delphi Ventures, Sfermion, Momentum 6 (M6), 3Commas Capital, Kosmos Ventures, CSP DAO, Devmons.

Nyan Heroes is an NFT game built on the Solana blockchain, that is part of the "play to earn" metaverse.

Nyan Heroes is an NFT game built on the Solana blockchain, that is part of the "play to earn" metaverse.

D2X raised $10M in a Series A funding round from Point72 Ventures*, GSR Markets LTD, Tioga Capital Partners, Picus Capital, TRGC, Jabre Capital Partners Family Office, Fortino Capital.

D2X is an EU-regulated derivatives exchange specializing in crypto options and futures, serving institutional investors with a focus on regulatory compliance and operational excellence. It operates under MiCA, the EU’s regulatory framework for digital assets, offering a high-performance trading environment and robust risk management to address the challenges faced by institutional players in the digital asset space.

D2X is an EU-regulated derivatives exchange specializing in crypto options and futures, serving institutional investors with a focus on regulatory compliance and operational excellence. It operates under MiCA, the EU’s regulatory framework for digital assets, offering a high-performance trading environment and robust risk management to address the challenges faced by institutional players in the digital asset space.

Param Labs raised undisclosed amount in a funding round from Animoca Brands.

Param Labs is an AAA game and blockchain development studio focused on creating top-tier blockchain-integrated games with player-owned digital assets. With headquarters in Europe and the United States, they lead in developing high-quality MMO games, aiming to merge traditional gaming with Web3 through user-friendly experiences and sustainable ecosystems. Their projects include the Multiplayer Game KIRAVERSE and the 3D game-ready avatar usable in Rockstar games and Fortnite, Pixel To Poly, among others.

Param Labs is an AAA game and blockchain development studio focused on creating top-tier blockchain-integrated games with player-owned digital assets. With headquarters in Europe and the United States, they lead in developing high-quality MMO games, aiming to merge traditional gaming with Web3 through user-friendly experiences and sustainable ecosystems. Their projects include the Multiplayer Game KIRAVERSE and the 3D game-ready avatar usable in Rockstar games and Fortnite, Pixel To Poly, among others.

Syntropy raised undisclosed amount in a funding round from CMCC Global, P2 Ventures (Polygon Ventures), HV Capital, Faculty Group, Wave Capital, Moonrock Capital, DVNCI Capital, TRGC, Mapleblock Capital, AntAlpha, Public Works, Goldich Consulting.

Syntropy is a transformative platform that revolutionizes blockchain data access through its innovative Data Layer protocol. By enabling seamless and decentralized data exchange, Syntropy empowers developers, organizations, and users to access real-time and historical on-chain data efficiently, securely, and equitably. The platform's Publish-Subscribe protocol, application-specific chains, and tokenomics framework form the backbone of its ecosystem, facilitating the exchange of data between Publishers and Subscribers in a decentralized and incentivized manner.

Syntropy is a transformative platform that revolutionizes blockchain data access through its innovative Data Layer protocol. By enabling seamless and decentralized data exchange, Syntropy empowers developers, organizations, and users to access real-time and historical on-chain data efficiently, securely, and equitably. The platform's Publish-Subscribe protocol, application-specific chains, and tokenomics framework form the backbone of its ecosystem, facilitating the exchange of data between Publishers and Subscribers in a decentralized and incentivized manner.

Carbonated (MadWorld) raised $11M in a Series A funding round from com2us*, Andreessen Horowitz (a16z crypto), BITKRAFT Ventures, Cypher Capital, Blocore, Goal Ventures, WAGMI Ventures.

Carbonated is a mobile game developer specialising in hardcore PvP games, with their flagship product "MadWorld," a post-apocalyptic NFT shooting game set in a devastated Earth. MadWorld allows players to collect and trade tokenized land assets, engage in third-person shooter gameplay across various maps and modes, recruit and evolve squad mates, and strategically expand their territory while competing against rival clans.

Carbonated is a mobile game developer specialising in hardcore PvP games, with their flagship product "MadWorld," a post-apocalyptic NFT shooting game set in a devastated Earth. MadWorld allows players to collect and trade tokenized land assets, engage in third-person shooter gameplay across various maps and modes, recruit and evolve squad mates, and strategically expand their territory while competing against rival clans.

DLC Link raised undisclosed amount in a funding round from OKX Ventures (ex OKEx Blockdream Ventures)*.

DLC Link introduces a trustless bridge to Ethereum's DeFi ecosystem, utilizing Discreet Log Contracts (DLCs) to securely represent Bitcoin on the Ethereum blockchain as dlcBTC tokens. With DLCs, users retain full control of their assets, participating in DeFi protocols without relying on intermediaries or custodians, ensuring robust security and user sovereignty. DLC Link's innovative approach enables seamless cross-chain communication, offering distinct advantages over traditional wrapped Bitcoin (wBTC) solutions, including self-wrapping, faster transactions, and competitive fees.

DLC Link introduces a trustless bridge to Ethereum's DeFi ecosystem, utilizing Discreet Log Contracts (DLCs) to securely represent Bitcoin on the Ethereum blockchain as dlcBTC tokens. With DLCs, users retain full control of their assets, participating in DeFi protocols without relying on intermediaries or custodians, ensuring robust security and user sovereignty. DLC Link's innovative approach enables seamless cross-chain communication, offering distinct advantages over traditional wrapped Bitcoin (wBTC) solutions, including self-wrapping, faster transactions, and competitive fees.

OrangeDX raised $1.5M in a funding round from Genesis Block Ventures Capital (GBV), Oddiyana Ventures, NxGen, Triple Gem Capital, x21 Digital, Alphabit, Spicy Capital.

OrangeDX is a first-generation Bitcoin DEFI Hub, serving as a comprehensive platform for the Bitcoin Protocol. It facilitates bridging, trading, swapping, securing, and launching BRC20 and bridged EVM tokens, offering additional services such as borrowing and lending. Positioned as the BRC20 equivalent of Uniswap, Aave, and GMX, OrangeDX's DeFI aggregator prioritizes user experience and innovative opportunities, establishing itself as a new frontier for DeFi enthusiasts.

OrangeDX is a first-generation Bitcoin DEFI Hub, serving as a comprehensive platform for the Bitcoin Protocol. It facilitates bridging, trading, swapping, securing, and launching BRC20 and bridged EVM tokens, offering additional services such as borrowing and lending. Positioned as the BRC20 equivalent of Uniswap, Aave, and GMX, OrangeDX's DeFI aggregator prioritizes user experience and innovative opportunities, establishing itself as a new frontier for DeFi enthusiasts.

UXLINK raised $9M in a funding round from OKX Ventures (ex OKEx Blockdream Ventures), Web3Port Labs, KuCoin Labs, Manifold, Comma3 Ventures, UOB Venture Management, Forgame, 7UpDAO, Gate Labs.

UXLINK is a Web3 social platform designed for mass adoption, offering users the ability to create social assets and participate in cryptocurrency trading. This innovative platform includes a range of modularized Dapps covering onboarding, social graph formation, group tools, and socialized trading.

UXLINK is a Web3 social platform designed for mass adoption, offering users the ability to create social assets and participate in cryptocurrency trading. This innovative platform includes a range of modularized Dapps covering onboarding, social graph formation, group tools, and socialized trading.

DeMR raised undisclosed amount in a Angel funding round from KuCoin Labs, DWF Labs, JDI Ventures, Meteorite Labs, Redline Labs, PAKA.

DeMR is a decentralized infrastructure network on the Solana Chain focused on Mixed Reality (MR). It allows global users to scan and develop MR maps of cities using consumer-grade devices, fostering a Web3 ecosystem that merges the virtual and real worlds through MR & AI spatial computing technology. Participants in the DeMR Network, including Contributors and Developers, are incentivized with the DMR token for tasks like scanning and building MR applications, creating a vast decentralized MR metaverse with advanced spatial computation capabilities.

DeMR is a decentralized infrastructure network on the Solana Chain focused on Mixed Reality (MR). It allows global users to scan and develop MR maps of cities using consumer-grade devices, fostering a Web3 ecosystem that merges the virtual and real worlds through MR & AI spatial computing technology. Participants in the DeMR Network, including Contributors and Developers, are incentivized with the DMR token for tasks like scanning and building MR applications, creating a vast decentralized MR metaverse with advanced spatial computation capabilities.

Shentu Chain raised undisclosed amount in a funding round from Binance Labs Fund, OKX Ventures (ex OKEx Blockdream Ventures), Bitmain, KuCoin Ventures, Neo Blockchain, DHVC (Danhua Capital), Draper Dragon, Fenbushi Capital, Matrix Partners, Lightspeed.

Shentu Chain is a security-oriented blockchain that prioritizes provable trust, offering features such as the Shentu Open Bounty platform for Web3 projects, the Shentu Security Oracle for on-chain safeguards, and the ShentuShield Pool system for decentralized asset reimbursement. Leveraging technologies like DeepSEA and the Shentu Certified Virtual Machine (CVM), Shentu Chain ensures trustworthy smart contracts and a reliable development environment, making it a comprehensive solution for secure and transparent blockchain operations.

Shentu Chain is a security-oriented blockchain that prioritizes provable trust, offering features such as the Shentu Open Bounty platform for Web3 projects, the Shentu Security Oracle for on-chain safeguards, and the ShentuShield Pool system for decentralized asset reimbursement. Leveraging technologies like DeepSEA and the Shentu Certified Virtual Machine (CVM), Shentu Chain ensures trustworthy smart contracts and a reliable development environment, making it a comprehensive solution for secure and transparent blockchain operations.

Elixir Protocol raised $8M in a Series B funding round from Mysten Labs*, Maelstrom*, Manifold, Amber Group, GSR Markets LTD, Flowdesk, Arthur Hayes.

Elixir is a decentralized protocol designed to offer computationally-secure algorithmic market making across both centralized and decentralized exchanges. It aims to bring deeper liquidity, tighter bid-ask spreads, and increased trading volume by allowing users to supply liquidity directly to order book exchanges, earning maker rewards with a similar risk-return profile to AMMs.

Elixir is a decentralized protocol designed to offer computationally-secure algorithmic market making across both centralized and decentralized exchanges. It aims to bring deeper liquidity, tighter bid-ask spreads, and increased trading volume by allowing users to supply liquidity directly to order book exchanges, earning maker rewards with a similar risk-return profile to AMMs.

MetaCene raised $10M in a Series A funding round from Folius Ventures, SevenX Ventures, The Spartan Group, Mantle Network, Animoca Brands, Longling Capital, Comma3 Ventures, IGG: I Got Games.

MetaCene is a blockchain-based MMORPG that offers a unique post-apocalyptic world where players use NFTs to redefine civilization. With a focus on player-centric entertainment and governance, MetaCene combines Web2 and Web3 elements to create an innovative gaming experience.

MetaCene is a blockchain-based MMORPG that offers a unique post-apocalyptic world where players use NFTs to redefine civilization. With a focus on player-centric entertainment and governance, MetaCene combines Web2 and Web3 elements to create an innovative gaming experience.

Privasea raised undisclosed amount in a funding round from Danu Ventures.

Privasea AI Network is a solution addressing data privacy challenges in artificial intelligence. Integrating Fully Homomorphic Encryption with blockchain-based incentives, it revolutionizes machine learning inferencing, enhances privacy, and facilitates collaborative AI computations while ensuring secure and private AI computing experiences for users.

Privasea AI Network is a solution addressing data privacy challenges in artificial intelligence. Integrating Fully Homomorphic Encryption with blockchain-based incentives, it revolutionizes machine learning inferencing, enhances privacy, and facilitates collaborative AI computations while ensuring secure and private AI computing experiences for users.

Solak raised undisclosed amount in a Strategic funding round from DWF Labs, Oddiyana Ventures, IBC Group.

Solak is an ecosystem merging cutting-edge AI technology with decentralized finance (DeFi) features. It offers services such as an AI-powered browser and a DeFi platform, allowing users to earn SGPT tokens through activities like internet browsing, engaging in DeFi, participating in the NFT platform, and potentially through a referral program. SolakGPT also supports various operating systems such as Window, Mac, IOS, Andorid, and Solak Text to NFT is a unique feature enabling users to transform their written content into NFTs, offering a digital presence and potential value in the NFT space.

Solak is an ecosystem merging cutting-edge AI technology with decentralized finance (DeFi) features. It offers services such as an AI-powered browser and a DeFi platform, allowing users to earn SGPT tokens through activities like internet browsing, engaging in DeFi, participating in the NFT platform, and potentially through a referral program. SolakGPT also supports various operating systems such as Window, Mac, IOS, Andorid, and Solak Text to NFT is a unique feature enabling users to transform their written content into NFTs, offering a digital presence and potential value in the NFT space.

Studio 369 (MetalCore) raised $5M in a funding round from Delphi Digital, BITKRAFT Ventures, Sanctor Capital, The Spartan Group.

Studio 369 is the creator of "MetalCore," a blockchain-based PVP shooter game. It features a dynamic AI-driven mission system and integrates with Immutable zkEVM for gas-free experiences like crafting, upgrades, and purchases. "MetalCore" is in closed beta, listed for early access on Epic Games Store.

Studio 369 is the creator of "MetalCore," a blockchain-based PVP shooter game. It features a dynamic AI-driven mission system and integrates with Immutable zkEVM for gas-free experiences like crafting, upgrades, and purchases. "MetalCore" is in closed beta, listed for early access on Epic Games Store.

Ethernity Chain raised undisclosed amount in a funding round from Morningstar Ventures.

Ethernity Chain is a community-oriented platform that produces limited edition authenticated NFTs and trading cards created by your favorite artists and endorsed by notable figures.

Ethernity Chain is a community-oriented platform that produces limited edition authenticated NFTs and trading cards created by your favorite artists and endorsed by notable figures.

Asterix Labs raised undisclosed amount in a Strategic funding round from Spirit DAO, dingaling, Kevin Lin, Ray Chan, Grail eth, Icedcoffee, Karl Mjardsjo, MYC_006, Arthur0x, Adrian Lai, Char, John Ng Pangilinan, Clement, Christianeth.

Asterix is a digital ownership platform that sets standards for the future, powered by DN404. DN404 is a contract linking a fungible ERC-20 token and a non-fungible ERC-721 token, ensuring actions on one contract are reflected on the other. The platform offers the $ASTX token and corresponding NFTs, with ownership mirrored between the two, and users can purchase them on various marketplaces like Opensea, Blur, and Opensea Pro.

Asterix is a digital ownership platform that sets standards for the future, powered by DN404. DN404 is a contract linking a fungible ERC-20 token and a non-fungible ERC-721 token, ensuring actions on one contract are reflected on the other. The platform offers the $ASTX token and corresponding NFTs, with ownership mirrored between the two, and users can purchase them on various marketplaces like Opensea, Blur, and Opensea Pro.

KicksPad raised undisclosed amount in a funding round from Gotbit Hedge Fund.

KicksPad is a platform that empowers innovators and investors with its native token $KICKS, providing access to exclusive private and public token sales. The platform offers a whitelist registration for early supporters, allowing them the opportunity to participate in upcoming Initial DEX Offerings (IDOs) and receive special benefits from the KicksPad team.

KicksPad is a platform that empowers innovators and investors with its native token $KICKS, providing access to exclusive private and public token sales. The platform offers a whitelist registration for early supporters, allowing them the opportunity to participate in upcoming Initial DEX Offerings (IDOs) and receive special benefits from the KicksPad team.

SnowSeed raised $5M in a funding round from Medi Crypto International (MCI), Buckingham Holdings Indonesia.

SnowSeed is an NFT crowdfunding platform based in Indonesia that introduces an innovative investment model similar to basic income. Investors on SnowSeed can earn USDC interest and mine PDT tokens through a variety of investment products, spanning real estate development, visionary projects, and ventures in the entertainment and arts sectors.

SnowSeed is an NFT crowdfunding platform based in Indonesia that introduces an innovative investment model similar to basic income. Investors on SnowSeed can earn USDC interest and mine PDT tokens through a variety of investment products, spanning real estate development, visionary projects, and ventures in the entertainment and arts sectors.

UniSat raised undisclosed amount in a funding round from Cryptogram Venture (CGV).

UniSat is a blockchain service provider with a user-friendly wallet, UniSat Wallet, enabling secure storage and transactions of bitcoins and Ordinals on the Bitcoin blockchain. It empowers users to explore the potential of Ordinals and BRC20 tokens, offering a comprehensive platform for inscription, trading, and management.

UniSat is a blockchain service provider with a user-friendly wallet, UniSat Wallet, enabling secure storage and transactions of bitcoins and Ordinals on the Bitcoin blockchain. It empowers users to explore the potential of Ordinals and BRC20 tokens, offering a comprehensive platform for inscription, trading, and management.

Eclipse raised $50M in a Series A funding round from Placeholder*, Hack VC*, Polychain Capital, Delphi Digital, Maven 11 Capital, DBA, Fenbushi Capital.

Eclipse is a customizable rollup provider that is compatible with multiple layer-1 blockchains. The platform enables developers to deploy their own rollup powered by the Solana operating system, using any chain for security or data storage.

Eclipse is a customizable rollup provider that is compatible with multiple layer-1 blockchains. The platform enables developers to deploy their own rollup powered by the Solana operating system, using any chain for security or data storage.

XLink BTC raised undisclosed amount in a funding round from Foresight X, Bitcoin Frontier Fund, BitcoinLab, LK Venture, AVID3, BlockBooster, Cypher Capital, Gate Ventures, Great South Gate (GSG), Incuba Alpha, KuCoin Ventures, Kyros Ventures, Oak Grove Ventures.

XLink BTC is a Bitcoin bridge developed by ALEX, serving as a crucial component of the ALEX ecosystem. This Bitcoin Bridge simplifies the user experience by abstracting the differences between Layer 1 and Layer 2, enabling users to seamlessly engage in a "native-like" Bitcoin DeFi experience on L1. Users can utilize native BTC or L1 assets issued on Bitcoin to interact with Layer 2 smart contracts through this bridge.

XLink BTC is a Bitcoin bridge developed by ALEX, serving as a crucial component of the ALEX ecosystem. This Bitcoin Bridge simplifies the user experience by abstracting the differences between Layer 1 and Layer 2, enabling users to seamlessly engage in a "native-like" Bitcoin DeFi experience on L1. Users can utilize native BTC or L1 assets issued on Bitcoin to interact with Layer 2 smart contracts through this bridge.

NFTfi raised $6M in a Series A funding round from Placeholder*, Maven 11 Capital, Launch Labs Inc, Kahuna Ventures, Brevan Howard Digital, THE LAO, Reciprocal Ventures, A Capital, Hash Global, Bloccelerate, Cypher Capital, LongHash Ventures.

NFTfi is an NFT lending protocol that allows NFT holders to leverage their digital assets as collateral to borrow cryptocurrency. Users can list their NFTs, receive loan offers from other users, accept the best offer, and, upon repayment, automatically retrieve their NFTs in a secure, transparent, and non-custodial manner. The platform operates on Ethereum, offers fixed loan terms, and charges borrowers a 0% fee, providing a secure solution for unlocking financial opportunities tied to valuable NFTs.

NFTfi is an NFT lending protocol that allows NFT holders to leverage their digital assets as collateral to borrow cryptocurrency. Users can list their NFTs, receive loan offers from other users, accept the best offer, and, upon repayment, automatically retrieve their NFTs in a secure, transparent, and non-custodial manner. The platform operates on Ethereum, offers fixed loan terms, and charges borrowers a 0% fee, providing a secure solution for unlocking financial opportunities tied to valuable NFTs.

* fund, that lead investment round

Telegram

Telegram