This week's biggest funding round

Meanwhile raised $19M in a Seed funding round from Sam Altman*, Gradient Ventures*, 6th Man Ventures (6MV), Mouro Capital, Hudson Structured Capital Management.

Meanwhile is a life insurance company that offers policies denominated in Bitcoin (BTC). It provides a tax-advantaged way for policyholders to leverage their Bitcoin wealth and pass it on to the next generation. With guaranteed growth, liquidity options, and a focus on generational wealth transfer, Meanwhile aims to provide innovative solutions in the insurance industry using digital currencies.

Meanwhile is a life insurance company that offers policies denominated in Bitcoin (BTC). It provides a tax-advantaged way for policyholders to leverage their Bitcoin wealth and pass it on to the next generation. With guaranteed growth, liquidity options, and a focus on generational wealth transfer, Meanwhile aims to provide innovative solutions in the insurance industry using digital currencies.

Pre-seed and Seed investment rounds

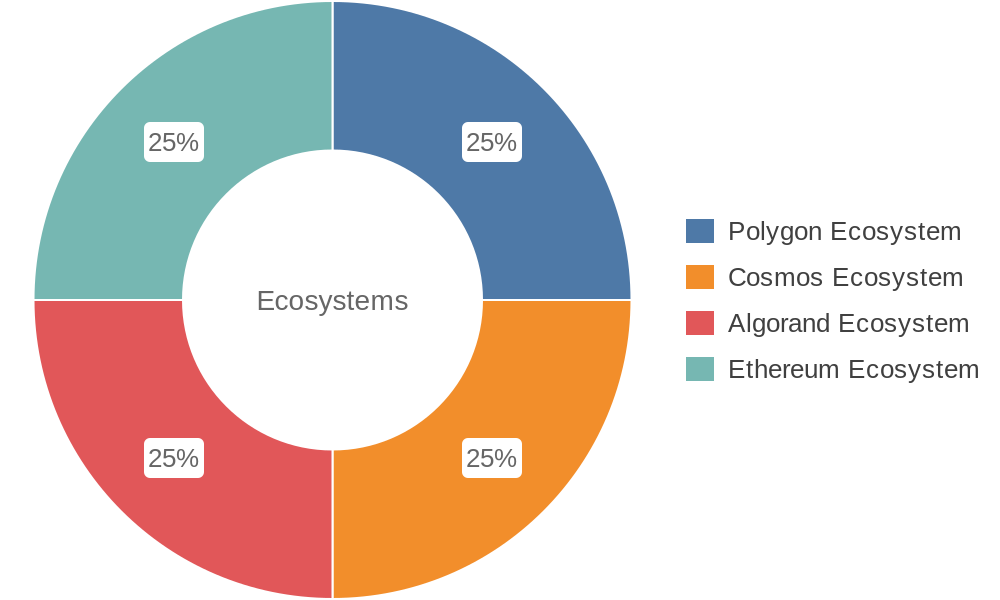

Taiko raised $12M in a Seed funding round from Generative Ventures*, IOSG Ventures, GSR, GGV Capital, WWVentures, BAI Capital, KuCoin Ventures, Mirana Ventures, OKX Ventures (ex OKEx Blockdream Ventures), Skyland Ventures, Tokenbay Capital, Yunqi Partners.

Taiko is an open-source, community-driven project focused on building a decentralized scaling solution for the Ethereum blockchain. They are developing a Type 1 zero-knowledge Ethereum Virtual Machine (zkEVM), aiming to emulate the design and ideology of Ethereum while providing scalability.

Taiko is an open-source, community-driven project focused on building a decentralized scaling solution for the Ethereum blockchain. They are developing a Type 1 zero-knowledge Ethereum Virtual Machine (zkEVM), aiming to emulate the design and ideology of Ethereum while providing scalability.

SafeBay raised $1.1M in a Seed funding round from Big Sky Capital, Borderless Capital, AXL ventures, Algorand.

SafeBay Finance is a DeFi treasury platform for Web3 developed by an investment platform Kilde. SafeBay serves as a treasury management system that helps blockchain-native companies effectively manage their short-term financial assets. With SafeBay, companies can access a comprehensive range of fixed-income products on the blockchain, ensuring compliance with industry regulations and fostering a secure and compliant financial ecosystem.

SafeBay Finance is a DeFi treasury platform for Web3 developed by an investment platform Kilde. SafeBay serves as a treasury management system that helps blockchain-native companies effectively manage their short-term financial assets. With SafeBay, companies can access a comprehensive range of fixed-income products on the blockchain, ensuring compliance with industry regulations and fostering a secure and compliant financial ecosystem.

ARGUS raised $10M in a Seed funding round from HAUN Ventures*, Alchemy Ventures, Robot Ventures, Anagram, Dispersion Capital, Elad Gil, Balaji Srinivasan.

Argus is a project focused on advancing the crypto gaming ecosystem by developing innovative infrastructure, game economy designs, and primitives. It aims to enable seamless communication and interoperability between games, marketplaces, public good game infrastructures, and user-generated content platforms. Argus integrates content creation directly with game logic and data, breaking free from the constraints imposed by traditional platforms.

Argus is a project focused on advancing the crypto gaming ecosystem by developing innovative infrastructure, game economy designs, and primitives. It aims to enable seamless communication and interoperability between games, marketplaces, public good game infrastructures, and user-generated content platforms. Argus integrates content creation directly with game logic and data, breaking free from the constraints imposed by traditional platforms.

Meanwhile raised $19M in a Seed funding round from Sam Altman*, Gradient Ventures*, 6th Man Ventures (6MV), Mouro Capital, Hudson Structured Capital Management.

Meanwhile is a life insurance company that offers policies denominated in Bitcoin (BTC). It provides a tax-advantaged way for policyholders to leverage their Bitcoin wealth and pass it on to the next generation. With guaranteed growth, liquidity options, and a focus on generational wealth transfer, Meanwhile aims to provide innovative solutions in the insurance industry using digital currencies.

Meanwhile is a life insurance company that offers policies denominated in Bitcoin (BTC). It provides a tax-advantaged way for policyholders to leverage their Bitcoin wealth and pass it on to the next generation. With guaranteed growth, liquidity options, and a focus on generational wealth transfer, Meanwhile aims to provide innovative solutions in the insurance industry using digital currencies.

Dew Drops raised $1.5M in a Pre-seed funding round from Dream Ventures*, Vayner Fund, Polygon Ventures, Ruttenberg Gordon Investments (RGI), Slow Ventures.

Dew Drops is a digital collectibles company that offer curated daily drops of digital collectibles delivered via SMS, providing artists with a meaningful channel to reach collectors through their platform. Dew Drops aims to simplify art discovery and connect artists with a global audience, offering a unique platform for selling and connecting with art enthusiasts.

Dew Drops is a digital collectibles company that offer curated daily drops of digital collectibles delivered via SMS, providing artists with a meaningful channel to reach collectors through their platform. Dew Drops aims to simplify art discovery and connect artists with a global audience, offering a unique platform for selling and connecting with art enthusiasts.

Oamo raised $1.3M in a Pre-seed funding round from White Star Capital*.

Oamo is a decentralized data broker that empowers individuals to own and monetize their data while remaining anonymous. By allowing users to connect their on-chain and off-chain data sources through a decentralized identity, Oamo enables businesses to access high-quality leads and generate deep insights reports. The platform also facilitates personalized offers and promotions directly to users, creating a more efficient and user-centric relationship between consumers and businesses in the Web3 world.

Oamo is a decentralized data broker that empowers individuals to own and monetize their data while remaining anonymous. By allowing users to connect their on-chain and off-chain data sources through a decentralized identity, Oamo enables businesses to access high-quality leads and generate deep insights reports. The platform also facilitates personalized offers and promotions directly to users, creating a more efficient and user-centric relationship between consumers and businesses in the Web3 world.

Other investment rounds

HyperPlay raised $12M in a Series A funding round from Griffin Gaming Partners*, BITKRAFT Ventures*, ConsenSys, Ethereal Ventures, Delphi Digital, Game7 (GDC), Mirana Ventures, Monoceros.

HyperPlay is a web3-native game launcher that enables players to carry their wallet, NFTs, tokens, and achievements into every game. By tackling the challenge of Web3 gaming interoperability, HyperPlay enables developers to work without relying on centralized entities, while also offering a range of Web3 titles and monetization options without imposing taxes on in-game economies.

HyperPlay is a web3-native game launcher that enables players to carry their wallet, NFTs, tokens, and achievements into every game. By tackling the challenge of Web3 gaming interoperability, HyperPlay enables developers to work without relying on centralized entities, while also offering a range of Web3 titles and monetization options without imposing taxes on in-game economies.

Lens Protocol raised $15M in a funding round from IDEO CoLab Ventures*, General Catalyst, Variant Fund, Blockchain Capital, PTC Crypto (Palm Tree Crew), Flamingo, Punk DAO, dao5 (daofive), Global Coin Research (GCR), DAO Jones, Balaji Srinivasan, Sandeep Nailwal.

Lens Protocol is a user-owned Web3 social graph on the Polygon blockchain, empowering creators and enabling portability of content and connections. It prioritizes modularity and eliminates monopolistic fees, offering a decentralized and composable social media experience.

Lens Protocol is a user-owned Web3 social graph on the Polygon blockchain, empowering creators and enabling portability of content and connections. It prioritizes modularity and eliminates monopolistic fees, offering a decentralized and composable social media experience.

Informal Systems raised $5.3M in a funding round from CMCC Global*, Nascent, Maven 11 Capital, Celestia Foundation, EigenLayer.

Informal Systems is a core developer within the Cosmos interchain ecosystem, specializing in the development of essential components like the Tendermint consensus engine and the IBC interoperability standard. Their focus is on providing infrastructure, tools, and security auditing services to support the interchain ecosystem, improving software engineering practices through formal methods technology. Additionally, they have initiatives such as Collaborative Finance, aiming to integrate Cosmos technology with fintech products to offer liquidity systems for businesses.

Informal Systems is a core developer within the Cosmos interchain ecosystem, specializing in the development of essential components like the Tendermint consensus engine and the IBC interoperability standard. Their focus is on providing infrastructure, tools, and security auditing services to support the interchain ecosystem, improving software engineering practices through formal methods technology. Additionally, they have initiatives such as Collaborative Finance, aiming to integrate Cosmos technology with fintech products to offer liquidity systems for businesses.

Nori raised $6.3M in a funding round from M13*, Toyota Ventures*, Placeholder*, Cargill*.

Nori is a blockchain-based marketplace for carbon removal, aiming to reverse climate change by simplifying the process of paying people to remove carbon dioxide from the atmosphere. Through their platform, Nori enables carbon removal projects to measure and monetize their activities, connecting carbon removal suppliers directly with buyers.

Nori is a blockchain-based marketplace for carbon removal, aiming to reverse climate change by simplifying the process of paying people to remove carbon dioxide from the atmosphere. Through their platform, Nori enables carbon removal projects to measure and monetize their activities, connecting carbon removal suppliers directly with buyers.

* fund, that lead investment round

Telegram

Telegram