This week's biggest funding round

Auradine raised $81M in a Series A funding round from Celesta Capital*, Mayfield*, Marathon Digital Holdings, Cota Capital, Data Collective DCVC, Stanford University.

Auradine is a tech startup focused on developing next-generation web infrastructure aims to create scalable, sustainable, and secure solutions for the future of internet infrastructure. Leveraging technologies such as blockchain, AI, and zero-knowledge proofs, Auradine is poised to make a significant impact on decentralized applications and contribute to the transformation of the global economy.

Auradine is a tech startup focused on developing next-generation web infrastructure aims to create scalable, sustainable, and secure solutions for the future of internet infrastructure. Leveraging technologies such as blockchain, AI, and zero-knowledge proofs, Auradine is poised to make a significant impact on decentralized applications and contribute to the transformation of the global economy.

Pre-seed and Seed investment rounds

Azteco raised $6M in a Seed funding round from Jack Dorsey*, Lightning Ventures, Hivemind Ventures, Ride Wave Ventures, Aleka Capital, Visary Capital, Gaingels.

Azteco is a provider of a voucher system that enables users to save, spend, and send small amounts of bitcoin. Their solution addresses the financial needs of the unbanked population by offering a low-cost and secure alternative to traditional banking, leveraging the widespread use of smartphones. By utilizing Azteco vouchers, individuals can participate in global e-commerce and access the benefits of bitcoin without the need for a traditional bank account.

Azteco is a provider of a voucher system that enables users to save, spend, and send small amounts of bitcoin. Their solution addresses the financial needs of the unbanked population by offering a low-cost and secure alternative to traditional banking, leveraging the widespread use of smartphones. By utilizing Azteco vouchers, individuals can participate in global e-commerce and access the benefits of bitcoin without the need for a traditional bank account.

PYOR raised $4M in a Seed funding round from Castle Island Ventures*, Hash3, Antler, Future Perfect Ventures, Force Ventures, CoinSwitch, Coinbase Ventures, Balaji Srinivasan.

PYOR (Power Your Own Research) is a digital assets data platform aimed at accelerating institutional participation in Web3. It provides high-quality insights and data to institutions, offering a reliable source of truth for Web3 analytics. With features like interactive dashboards, custom metrics, and the ability to import data from various sources, PYOR enables users to conduct in-depth analysis and make informed investment decisions in the digital asset space.

PYOR (Power Your Own Research) is a digital assets data platform aimed at accelerating institutional participation in Web3. It provides high-quality insights and data to institutions, offering a reliable source of truth for Web3 analytics. With features like interactive dashboards, custom metrics, and the ability to import data from various sources, PYOR enables users to conduct in-depth analysis and make informed investment decisions in the digital asset space.

Lagrange raised $4M in a Pre-seed funding round from 1kx*, Maven 11 Capital, Lattice Fund, CMT Digital, Daedalus.

Lagrange Lab is a zero-knowledge (ZK) startup develops its ZK system enabling secure interoperability across different blockchain networks by providing generalized state proofs. Unlike traditional bridges and messaging protocols, the Lagrange Protocol allows for real-time cryptographic proofs of cross-chain states, enhancing security and enabling decentralized applications to operate seamlessly across multiple blockchains.

Lagrange Lab is a zero-knowledge (ZK) startup develops its ZK system enabling secure interoperability across different blockchain networks by providing generalized state proofs. Unlike traditional bridges and messaging protocols, the Lagrange Protocol allows for real-time cryptographic proofs of cross-chain states, enhancing security and enabling decentralized applications to operate seamlessly across multiple blockchains.

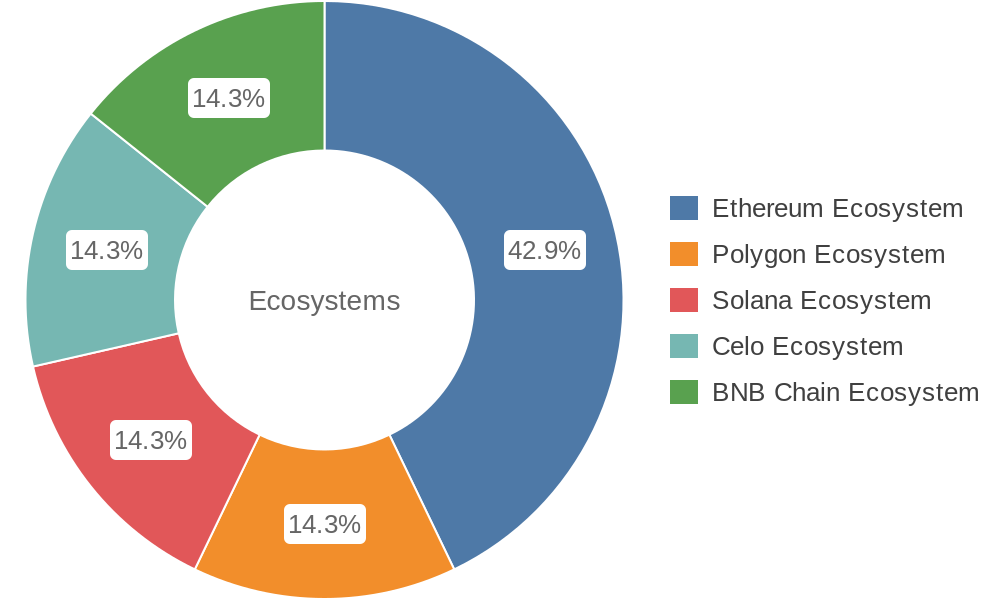

Airstack raised $7M in a Pre-seed funding round from Superscrypt*, Polygon Ventures, WWVentures, Resolute Ventures, Animal Ventures, Fenbushi Capital, Genblock Capital, NGC Ventures, Hashed Emergent, Primal Capital, United Overseas Bank (UOB), Signum Capital, Artichoke Capital, Cypher Capital, Kyber Ventures, Perridon Holdings, WestWave Capital, Acacia Digital Holdings, Lecca Ventures, CoinSwitch, Warburg Serres, Builder Capital, Delta Blockchain Fund.

Airstack is the web3 API platform aims to make it easy for individuals to discover and consume data from across the web3 ecosystem via APIs.

Airstack is the web3 API platform aims to make it easy for individuals to discover and consume data from across the web3 ecosystem via APIs.

Jia raised $4.3M in a Seed funding round from The Chernin Group (TCG Crypto)*, BlockTower Capital, Hashed Emergent, Saison Capital, Global Coin Research (GCR), Packy McCormick.

Jia is a decentralized lending protocol and fintech startup that connects capital to real yield opportunities from small businesses in emerging markets. By offering loans to micro and small businesses, Jia aims to bridge the access-to-finance gap and provide fair access to short-term loans. Through its platform, Jia incentivizes pro-ecosystem behavior, partners with high-quality data providers, and uses rewards tokens to deliver consistent yields to investors while supporting the growth of businesses in underserved markets.

Jia is a decentralized lending protocol and fintech startup that connects capital to real yield opportunities from small businesses in emerging markets. By offering loans to micro and small businesses, Jia aims to bridge the access-to-finance gap and provide fair access to short-term loans. Through its platform, Jia incentivizes pro-ecosystem behavior, partners with high-quality data providers, and uses rewards tokens to deliver consistent yields to investors while supporting the growth of businesses in underserved markets.

Story Protocol raised $29.3M in a Seed funding round from Andreessen Horowitz (a16z crypto)*, Hashed, Mirana Ventures, dao5 (daofive), Samsung Next, Two Small Fish Ventures, Berggruen Holdings, SLVC.

Story Protocol is a web3 technology that aims to transform storytelling by providing infrastructure for creators to build narrative universes and imaginary worlds using open source principles. It enables the creation, governance, and licensing of intellectual property on the blockchain, allowing for the development of an ecosystem of modular story components that can be remixed and combined in new and innovative ways.

Story Protocol is a web3 technology that aims to transform storytelling by providing infrastructure for creators to build narrative universes and imaginary worlds using open source principles. It enables the creation, governance, and licensing of intellectual property on the blockchain, allowing for the development of an ecosystem of modular story components that can be remixed and combined in new and innovative ways.

Asymmetry Finance raised $3M in a Seed funding round from Ecco Capital, Republic Capital (ex Republic Labs), gmjp (good morning japan), Ankr Network.

Asymmetry Finance is a protocol that addresses the centralization of the staked Ether market. It offers a sustainable yield generation model and diversification through its Asymmetry Ethereum Products (afETH & safETH). These products are Liquid Staked Token (LST) Ethereum Index products designed to distribute Total Value Locked (TVL) more equitably among LST providers.

Asymmetry Finance is a protocol that addresses the centralization of the staked Ether market. It offers a sustainable yield generation model and diversification through its Asymmetry Ethereum Products (afETH & safETH). These products are Liquid Staked Token (LST) Ethereum Index products designed to distribute Total Value Locked (TVL) more equitably among LST providers.

Hourglass raised $4.2M in a Seed funding round from Electric Capital*, Coinbase Ventures, Circle Ventures, Tribe Capital, Hack VC.

Hourglass is a protocol and RFQ marketplace that facilitates the trading of time-bound tokens (TBTs). TBTs represent staked assets in DeFi protocols that are committed for a specific duration. The marketplace allows users to unlock liquidity by selling the rights of the time duration in a secondary market, while also providing rewards for long-term alignment and enabling protocols to access committed liquidity.

Hourglass is a protocol and RFQ marketplace that facilitates the trading of time-bound tokens (TBTs). TBTs represent staked assets in DeFi protocols that are committed for a specific duration. The marketplace allows users to unlock liquidity by selling the rights of the time duration in a secondary market, while also providing rewards for long-term alignment and enabling protocols to access committed liquidity.

Other investment rounds

CoinCatch raised undisclosed amount in a Strategic funding round from ABCDE Capital*.

CoinCatch is a crypto derivatives exchange that specializes in social trading, allowing Key Opinion Leaders (KOLs) to share their trading strategies with their followers. It offers a secure and transparent platform for fast and convenient futures trading, including USDT futures, coin futures, and other popular futures.

CoinCatch is a crypto derivatives exchange that specializes in social trading, allowing Key Opinion Leaders (KOLs) to share their trading strategies with their followers. It offers a secure and transparent platform for fast and convenient futures trading, including USDT futures, coin futures, and other popular futures.

The The Open Network (TON) raised undisclosed amount in a funding round from Mask Network*.

TON (The Open Network) is a fully decentralized layer-1 blockchain developed by Telegram. It offers fast transactions, low fees, user-friendly applications, and eco-friendly features. TON aims to unite various blockchains and the existing internet, providing a scalable and secure platform capable of hosting a wide range of applications and services.

TON (The Open Network) is a fully decentralized layer-1 blockchain developed by Telegram. It offers fast transactions, low fees, user-friendly applications, and eco-friendly features. TON aims to unite various blockchains and the existing internet, providing a scalable and secure platform capable of hosting a wide range of applications and services.

Denarii Labs raised $25M in a funding round from Marc Andreessen, Chris Dixon, Animoca Brands, SuperRare.

Denarii Labs is a tokenomics accelerator program jointly powered by HLV (Horizen Labs Ventures) and Red Beard Ventures. It is designed to assist web3 builders in designing, developing, and executing their tokenomics and token launch strategies. The program offers a range of support, including advisory services, educational sessions, mentorship, and launch support, to help projects launching token offerings.

Denarii Labs is a tokenomics accelerator program jointly powered by HLV (Horizen Labs Ventures) and Red Beard Ventures. It is designed to assist web3 builders in designing, developing, and executing their tokenomics and token launch strategies. The program offers a range of support, including advisory services, educational sessions, mentorship, and launch support, to help projects launching token offerings.

River Financial raised $35M in a Series B funding round from Kingsway Capital*, Peter Thiel, Goldcrest Capital, Cygni Capital, M13, Valor Equity Partners, Esas Ventures, Alarko Ventures.

River Financial is a challenger financial institution that specializes in Bitcoin financial services. They offer a high-touch Bitcoin brokerage platform for sophisticated retail investors to buy and sell Bitcoin.

River Financial is a challenger financial institution that specializes in Bitcoin financial services. They offer a high-touch Bitcoin brokerage platform for sophisticated retail investors to buy and sell Bitcoin.

Lifeform raised undisclosed amount in a Series B funding round from IDG Capital*.

Lifeform is a decentralized visual digital identity (DID) solution provider. The platform’s core technologies include: hyper-realistic 3D avatar creation tools; visual DID protocols; secure and innovative contract solutions; decentralized identity systems for Web3 avatars; metaverse engine software development kits (SDKs).

Lifeform is a decentralized visual digital identity (DID) solution provider. The platform’s core technologies include: hyper-realistic 3D avatar creation tools; visual DID protocols; secure and innovative contract solutions; decentralized identity systems for Web3 avatars; metaverse engine software development kits (SDKs).

Getaverse raised undisclosed amount in a funding round from YBB Foundation*.

Getaverse is a blockchain credit system developed and deployed based on multiple public chains. The platform aims to create a metaverse ecological service platform based on the Web3 digital authentication engine protocol. After users register and enter Getaverse, they will obtain a DID identity.

Getaverse is a blockchain credit system developed and deployed based on multiple public chains. The platform aims to create a metaverse ecological service platform based on the Web3 digital authentication engine protocol. After users register and enter Getaverse, they will obtain a DID identity.

* fund, that lead investment round

Telegram

Telegram